With 2024 drawing to a close, market participants look forward to the possibility of a Santa Rally - a tendency for stock markets to rise during the last five trading days of December and the first two of the new year. What has been termed the "Santa Rally" is not just a myth of the holiday season but a well-observed phenomenon in financial markets that has drawn the interest of traders, analysts, and investors alike.

What is Santa Rally?

First noted by stock market enthusiasts in the early 1970s, the Santa Rally has become an annual focal point of market speculation. Historically, this period has been unusually good market momentum, with the S&P 500 often recording gains. Since 1950, the S&P 500 has risen about 77% during the Santa Rally period, with average gains ranging from 1.3% to 1.5% over these seven days. In 2023, the S&P 500 saw a gain of 1.7% during the Santa Rally, a continued phenomenon.

The Santa Rally is not all about holiday cheer. It's driven by psychological, technical, and fundamental factors that create favorable market conditions. Positive sentiment during the holiday season, adjustments by institutional investors, tax considerations, and lower trading volumes all contribute to the seasonal uptick.

The factors of that

Investor sentiment is closely linked with the holiday season, when investors generally have a reason to be cheerful, even more so if the macroeconomic data is supportive. The US economy was resilient during 2024, as seen from Q3 GDP, which grew at an annual rate of 4.9% on the back of strong consumer spending and surging exports. According to the Bureau of Economic Analysis, consumer spending, responsible for almost 70% of the US economy, grew 3.6% in Q3. Such economic strength sets the stage for positive sentiment, translating into market gains.

Another strong driver is the practice of "window dressing" by institutional investors, wherein portfolio managers rebalance their portfolios to reflect holdings in better-performing stocks at the end of the year. This year, it could be more pronounced as performance across sectors has been uneven. Fund managers will want to rebalance portfolios to show exposure to tech, which could add to market gains during the Santa Rally period.

Tax-loss harvesting also plays a significant role. Investors in the US commonly sell off their underperforming stocks to offset capital gains, then reinvest in other opportunities. This year, the volatility experienced in energy and smaller-cap stocks has led to a significant amount of tax-loss harvesting. Energy stocks, for example, have been down approximately 12% year-to-date, which has prompted many investors to lock in losses. Activities of reinvestment after these sales are likely to support a market rally, especially as investors reposition for a strong start to 2025.

The Santa Rally is also partly driven by lower trading volumes during the holiday period. Many institutional traders are away for holidays, and market participation is lower. Lower volumes can exaggerate price action, so even modest buying can translate into sizable gains. Because most central bank rate decisions for 2024 are already priced in, there is less risk of major macroeconomic surprises that could lead to quieter trading conditions and an increased likelihood of a seasonal rally.

What do we choose?

The US Federal Reserve has hinted at the possibility of a rate cut before the second quarter of 2025, which is usually good for indices and stocks. US CPI in October rose 3.2% year-on-year from 3.7% in September, indicating that inflation is gradually under control. This stabilization in monetary policy has boosted investor confidence, setting the stage for a potential rally later in the year. In the meantime, equity valuations have normalized following the pandemic's peak, with the forward P/E ratio for the S&P 500 at about 18.5, a bit above the historical average but within a range that would leave room for further growth without serious concerns about overvaluation.

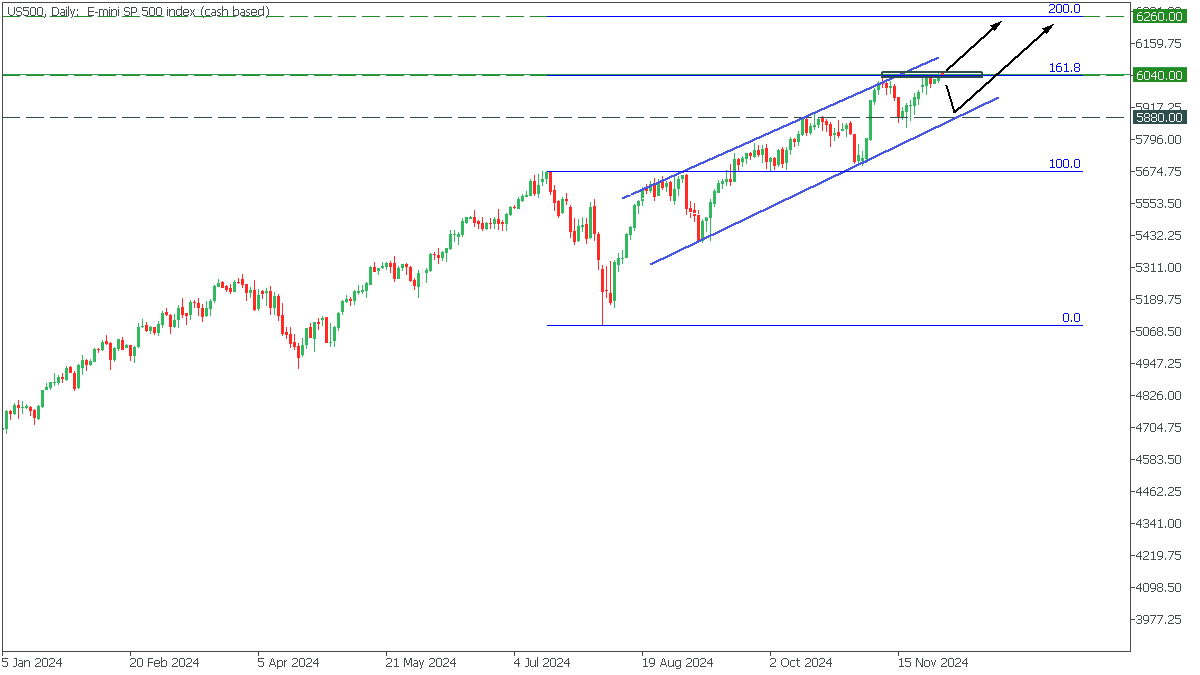

The US500, in a long-term bullish trend, has formed an ascending channel pattern. The price has updated its ATH and is consolidating at 161.8 Fibonacci. A small correction is possible before further growth.

It is possible to consider buying US500 on a break above 6040 with a target of 6260;

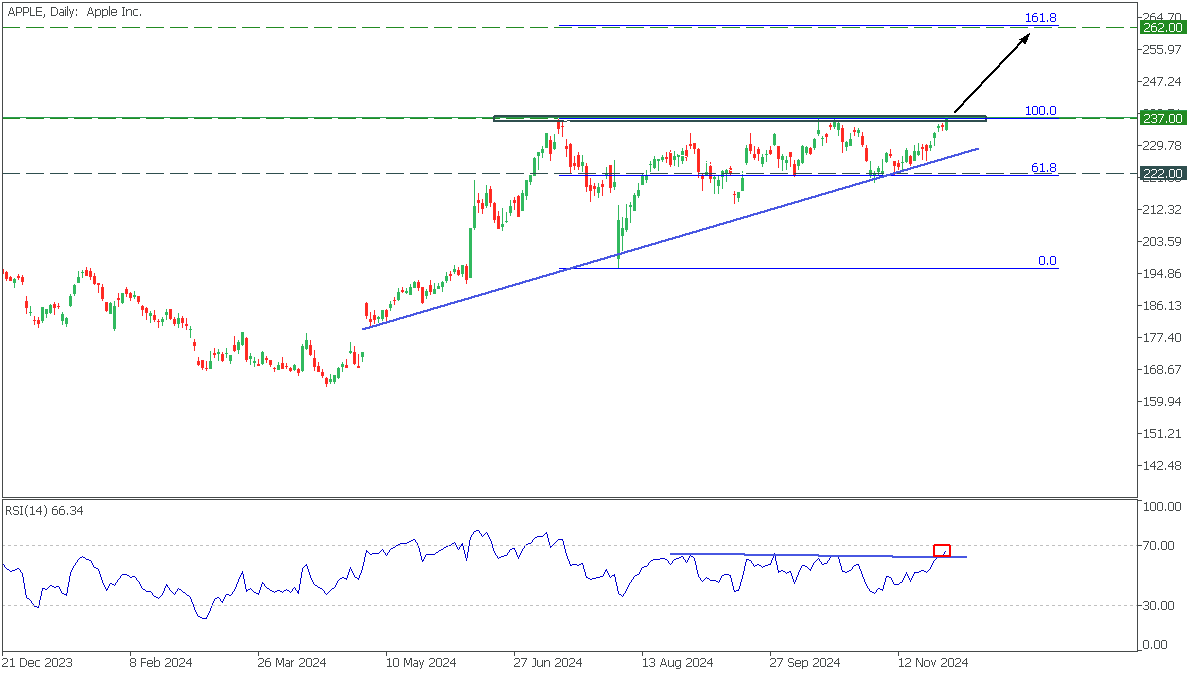

Apple, valued at over $3.7 trillion as of December 2024, has had an incredible year buoyed by demand for its latest iPhone 16 lineup and growth in its services segment, including Apple Music, iCloud, and Apple TV+. The services segment generated $87 billion in revenue over the last twelve months alone, accounting for a substantial portion of the company's profitability. In fact, strategic initiatives laid down by the company in India have been a major growth driver, while sales in the region were up 38% in 2024. Besides this, its foray into augmented reality products, specifically the Apple Vision Pro, has made the company a leader in the AR space, with strong pre-order numbers driving optimism among investors.

#APPLE has formed an ascending triangle pattern. The price reached the upper boundary, and the upward divergence was broken on the RSI, which allows for growth.

It may be considered to buy #APPLE on consolidation above 237 with a target of 262.

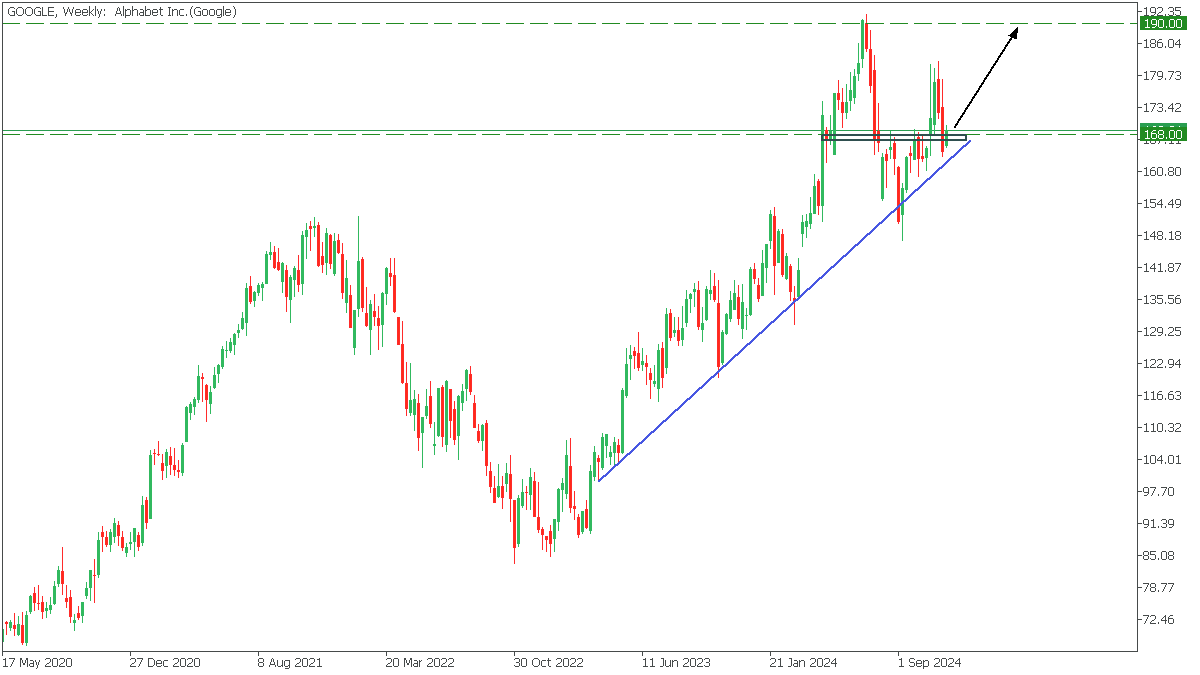

In 2024, Google reported $328 billion in revenue, up 14% from the previous year, thanks to strong performance in Google Cloud and its core advertising business. Revenue for Google Cloud grew 25% due to increased enterprise adoption of cloud solutions and turned profitable for the first time this year, marking a key milestone for the company. Where generative AI is concerned, especially with the success of its Bard AI project and AI integrations across Google Workspace, Alphabet has managed to stay ahead of competitors such as Microsoft and OpenAI.

#GOOGLE fell to the trend line after updating the all-time high and rebounded, making a small rise possible.

Buying #GOOGLE on consolidation above 168 with a target up to 190 may be considered.

Conclusion

The 2024 Santa Rally is well-positioned to cap off a year marked by mixed economic signals. While high interest rates have balanced resilient growth, markets have struggled at times against a backdrop of inflationary pressures and geopolitical tensions; nonetheless, the core elements for a year-end rally remain largely in place.

For investors, balancing risk and reward will be the key to success in this period. While history may favor the rally, the importance of diversification and caution cannot be overemphasized. The holiday season may bring cheer to portfolios, but ensuring exposure to stable sectors while being mindful of potential risks will be crucial in navigating the market into 2025.