The USDCAD currency pair experienced a sudden rise in buying strength as Donald Trump won the US presidential election. This win has given a significant boost to the US Dollar. In contrast, the Canadian Dollar looks weak ahead of crucial domestic employment data. Since Trump’s policies could lead to higher inflation through changes in tariffs and taxes, the US Federal Reserve may have to shift to a less easy-going (less dovish) stance. The dovish stance could increase Treasury yields and further strengthen the Dollar. However, higher tariffs on US imports would likely hurt the Canadian economy, which heavily relies on exporting goods to the US. Due on Friday, Canada’s job market data is another critical factor. If job growth is weaker than expected, the Canadian Dollar may drop, especially if the Bank of Canada considers more rate cuts. Traders also keenly anticipate the upcoming Federal Reserve meeting, where a rate cut is expected. Still, the main focus will be any hints about future rate decisions.

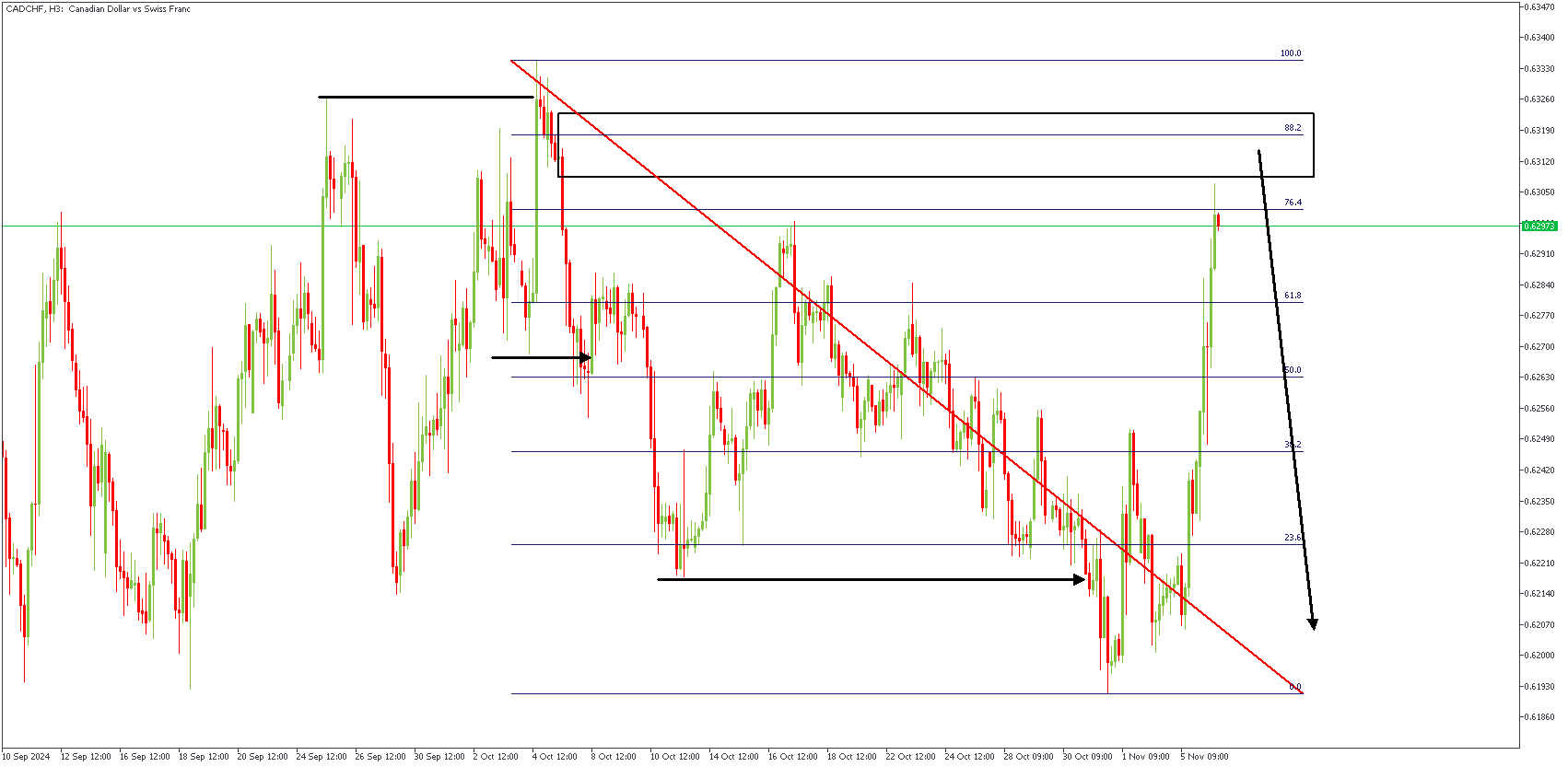

CADCHF – H3 Timeframe

Remember the SBR price action pattern? It’s shown by an initial sweep of a high or low, followed by a break of structure in the opposite direction to the sweep. The 3-hour timeframe of CADCHF shows such a pattern being formed as price swept above the high, followed by a bearish break of structure. The confluence here is the supply zone at the 88% Fibonacci retracement level, with the initial profit target at the 23% region.

Analyst’s Expectations:

Direction: Bearish

Target: 0.62236

Invalidation: 0.63351

NZDCAD – D1 Timeframe

.png)

NZDCAD, on the daily timeframe, has initially reacted off of the 76% Fibonacci retracement level. With trendline support as a confluence with the drop-base-rally demand zone, I’d say it’s pretty much locked and loaded in favor of the Bulls.

Analyst’s Expectations:

Direction: Bearish

Target: 0.84920

Invalidation: 0.81723

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.