Netflix Inc. (NFLX) is set to report its Q4 2024 earnings today, January 21, 2025. Below is a fundamental analysis of the company based on the latest data and projections.

Key Financial Highlights:

- Crecimiento de los ingresos: Se proyecta que los ingresos de Netflix en 2025 oscilarán entre 43.000 y 44.000 millones de dólares, lo que representa un aumento del 11% al 13% con respecto a los 38.900 millones de dólares estimados para 2024. (Fuente)

Margen operativo: Netflix espera un margen operativo del 28% en 2025, ligeramente superior al 27% de 2024.

Flujo de caja libre: Se informó un flujo de caja libre récord de 2.200 millones de dólares en el tercer trimestre de 2024, con un total estimado de 6.500 millones de dólares para el año.

Stock Projections:

- Consensus Target:

Analysts tracked by Visible Alpha maintain a consensus price target of $905, reflecting approximately 7% upside from the current price of $842. - Bullish Outlook:

Wedbush Securities has issued a price target of $950, citing Netflix’s "virtually insurmountable lead" in streaming and successful ad-supported tiers. - Cautious Revisions:

JPMorgan revised its target to $1,000 (down from $1,010), emphasizing the positive impact of the ad-supported tier and password-sharing crackdown on subscriber growth.

Strategic Drivers:

- Ad-Supported Tier:

This subscription plan, priced at $6.99, accounts for over 50% of new subscriptions in regions where available. It has reduced churn and is expected to drive incremental high-margin revenue. - Localized and Global Content Investments:

Netflix continues to prioritize regional productions while scaling its global appeal with high-profile releases like "One Hundred Years of Solitude."

Market Position:

- Subscriber Base:

Netflix reached 282.7 million paid subscribers by Q3 2024, reflecting a 14.4% year-over-year growth. - Streaming Leadership:

Analysts attribute Netflix’s dominance to its strong brand, diverse content library, and effective monetization strategies.

What to Watch in Q4 Results:

- Revenue Trends:

Wall Street expects Q4 revenue to grow by 15% YoY to $10.13 billion. - Earnings Projections:

Net income is expected to rise to $1.84 billion ($4.23 per share) from $937.8 million ($2.11 per share) in the prior year. - Shift in Metrics:

Starting this quarter, Netflix will no longer report subscriber numbers, focusing on financial performance and engagement metrics.

This analysis underscores Netflix’s robust growth prospects, which are driven by innovation in monetization and strong market positioning. The upcoming earnings report will provide more clarity on its trajectory into 2025.

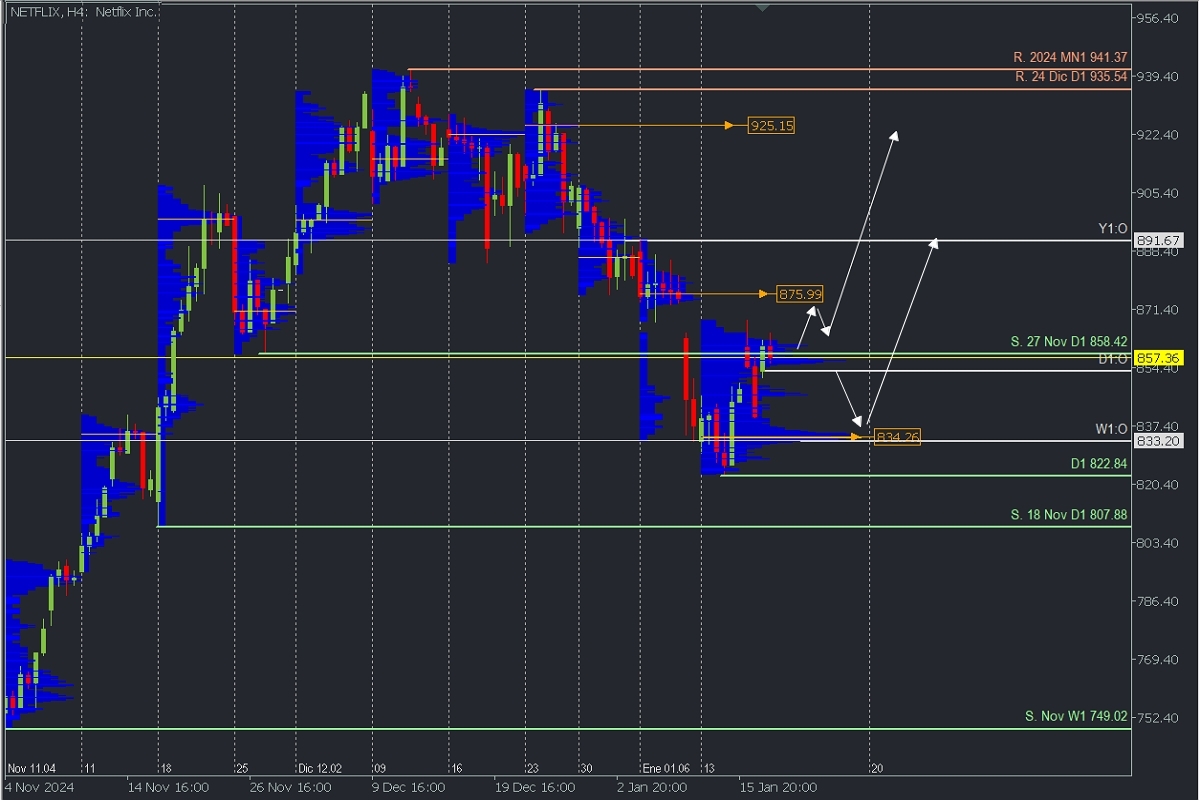

Technical Analysis

Netflix, H4

The price fell below the key daily support from November 27 at 858.42 last week, testing the daily uptrend. However, the week opened with a concentration of volume around 834.26, indicating increased buying interest.

At the same time, the price is approaching a weekly supply zone near 876, which could act as resistance and trigger selling toward the weekly open at 833.20, potentially creating a buying opportunity from that level.

If the bearish reaction remains moderate, a strong rebound is expected toward the yearly open at 891.67, with the potential to extend gains in the coming weeks toward December's supply zone near 925.15.