Today, we're breaking down the key points about Microsoft's upcoming earnings report, one of the most significant companies in the tech sector. Here’s a clear and simple analysis to help you understand what's happening with their stock and what to expect.

1. Expected Earnings

Microsoft is set to report its fiscal fourth-quarter earnings after the market closes. Analysts expect a 14.6% year-over-year increase in revenue, reaching $64.37 billion. Additionally, earnings per share (EPS) are projected to rise to $2.93, up 9.3% from last year's period.

2. Azure Growth

A major focus point will be the sustained growth of Microsoft’s Azure cloud platform. This segment is crucial as it has significantly contributed to earnings beats in previous quarters. Azure is expected to generate $37.2 billion in revenue, driven by strong demand for AI workloads.

3. AI Impact

Microsoft has established itself as a leader in the AI space, thanks to its ongoing partnership with OpenAI. Investors will be keen to hear updates on AI initiatives and new products designed for AI workloads, which could further bolster the company's computing business.

Technical Analysis

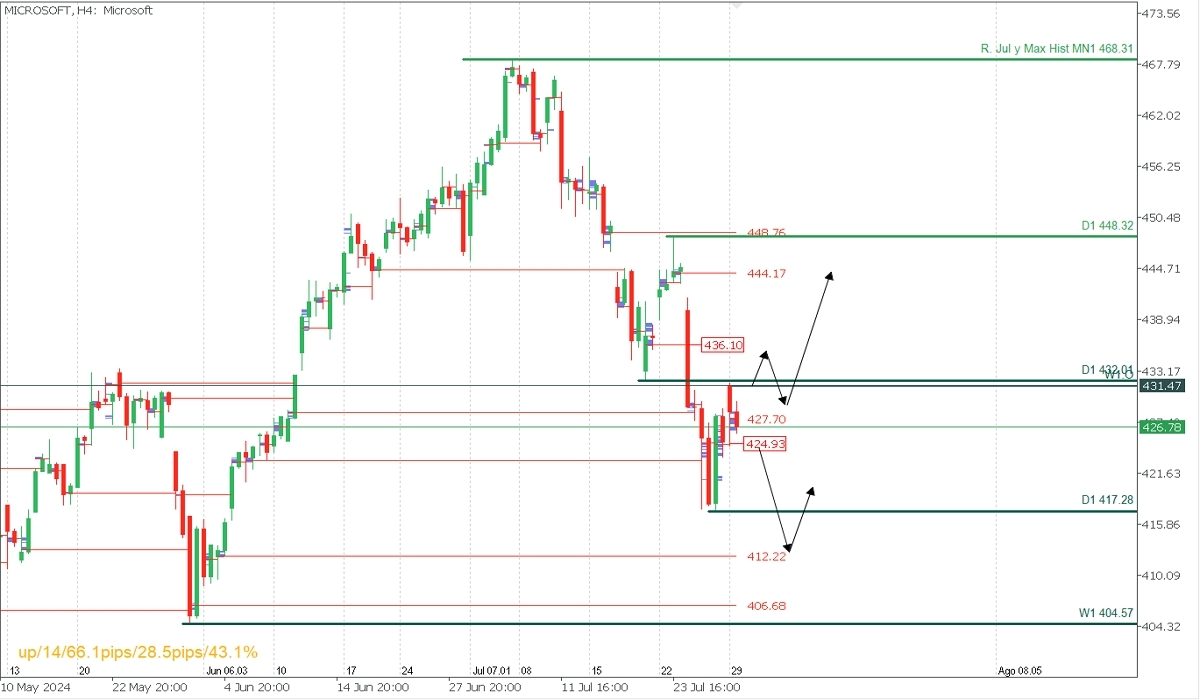

The stock has been in a macro downtrend since its all-time high on July 1, with last week's support at $417.24. Positive results and outlook could drive a recovery, pushing the stock towards resistance zones at $432.00 and $436.10, with potential further upside to $444.17 if these levels are broken.

However, a drop below the demand zone at $424.93 might extend the corrective phase towards the Point of Control (POC) at $412.22. A decisive breakout above resistance at $448.32 is needed to regain an upward trend.

Conversely, a significant trend change could occur if the weekly support at $404.57 is broken, though this scenario is currently seen as pessimistic and not aligned with the fundamentals.

Conclusion

Microsoft is well-positioned for strong performance, driven by its cloud and AI advancements. Despite recent corrections, the stock’s future trajectory will depend on upcoming earnings results and market reaction. Stay tuned for further updates!

I hope this analysis provides you with a clear understanding of Microsoft's current position and future potential. Feel free to reach out with any questions or comments!