MFA Financial Inc. announced that its Board of Directors has declared a quarterly dividend of $0.35 per share. The dividend will be paid on January 31, 2025, to shareholders on record as of December 31, 2024.

The company specializes in investments in residential mortgage loans, mortgage-backed securities, and real estate assets. MFA provides business-purpose loans through its subsidiary Lima One Capital for real estate investors. Since going public in 1998, MFA has distributed over $4.8 billion in dividends to its shareholders.

On Wednesday, MFA's stock edged up 0.09% to close at $10.91, in a mixed day for the markets. The stock remains $2.54 below its 52-week high of $13.45 on September 19. Trading volume stood at 1.1 million, above its 50-day average of 829,582 shares.

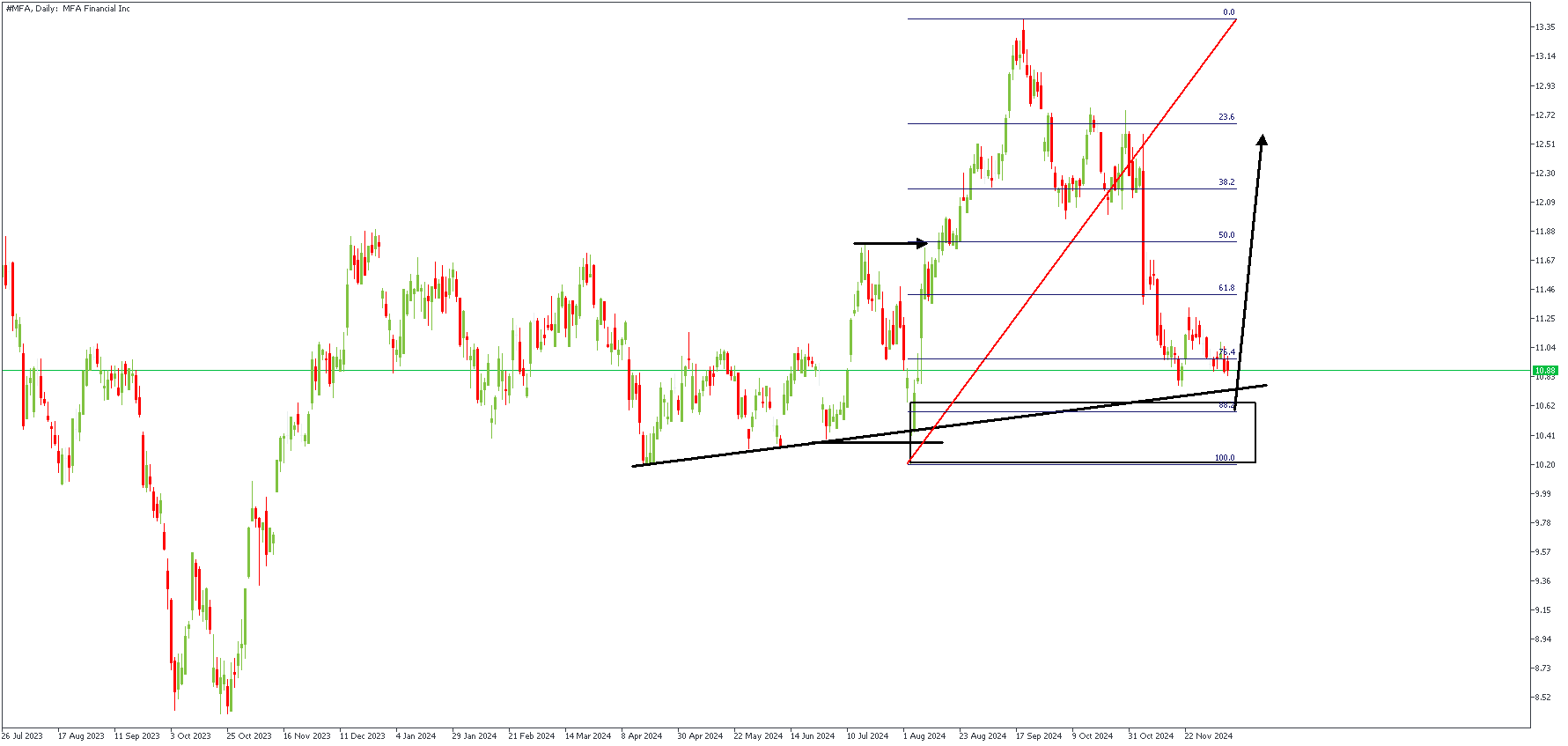

MFA – D1 Timeframe

The price action on the daily timeframe chart of MFA Financial stock shows a clear bullish break of structure above the highlighted high. The break impulse has been measured with a Fibonacci retracement tool, revealing that the price is near the 88% Fibonacci retracement level. Also, a trendline support aligns perfectly with the 88% level, and the drop-base-rally demand zone, solidifying the bullish sentiment.

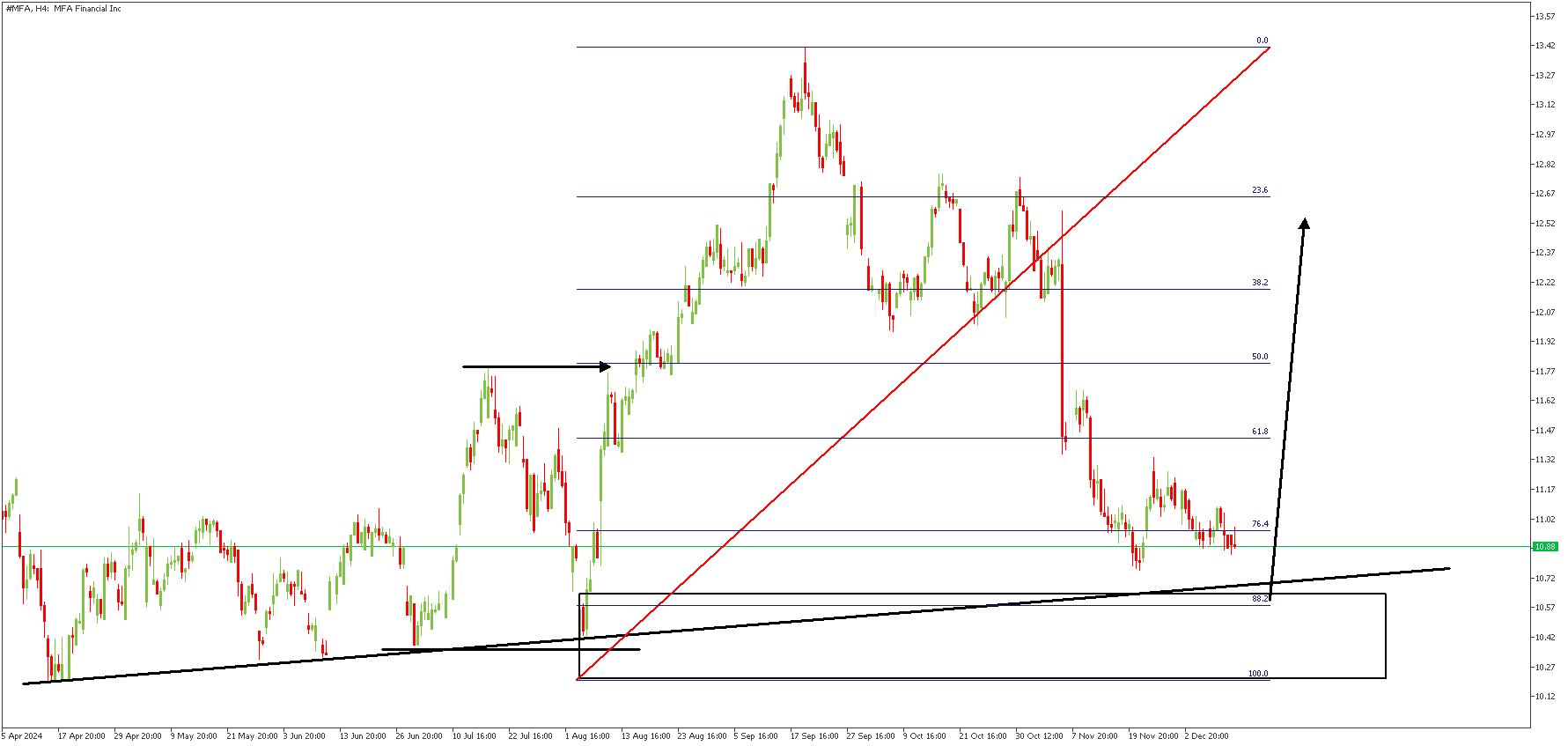

H4 Timeframe

The 4-hour timeframe chart of MFA stock prices clarifies the SBR (Sweep-Break-Retest) pattern created when the price swept below the previous low before proceeding to break above the high. As usual, this is solid evidence in favor of the bullish argument.

Analyst's Expectations:

Direction: Bullish

Target: 12.58

Invalidation: 10.01

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.