The US Dollar (USD) is struggling to gain strength as it begins the last trading day of the third quarter. Investors are closely watching for inflation data from Germany and speeches from key Federal Reserve officials, including Chairman Jerome Powell, later in the day. On Friday, the USD Index fell to its lowest point in over a year, hitting 100.15, before slightly recovering. Early Monday, the USD Index is still under pressure, staying below 100.50. Meanwhile, US stock index futures are trading slightly lower.

In China, economic data showed a decline in both the manufacturing and services sectors, putting more pressure on the country’s already struggling economy. However, the Australian dollar (AUD) has benefited from positive business confidence data, pushing AUDUSD to its highest level since February 2023. In the UK, revised GDP data showed slower growth than initially reported, but GBPUSD remains steady just below 1.3400.

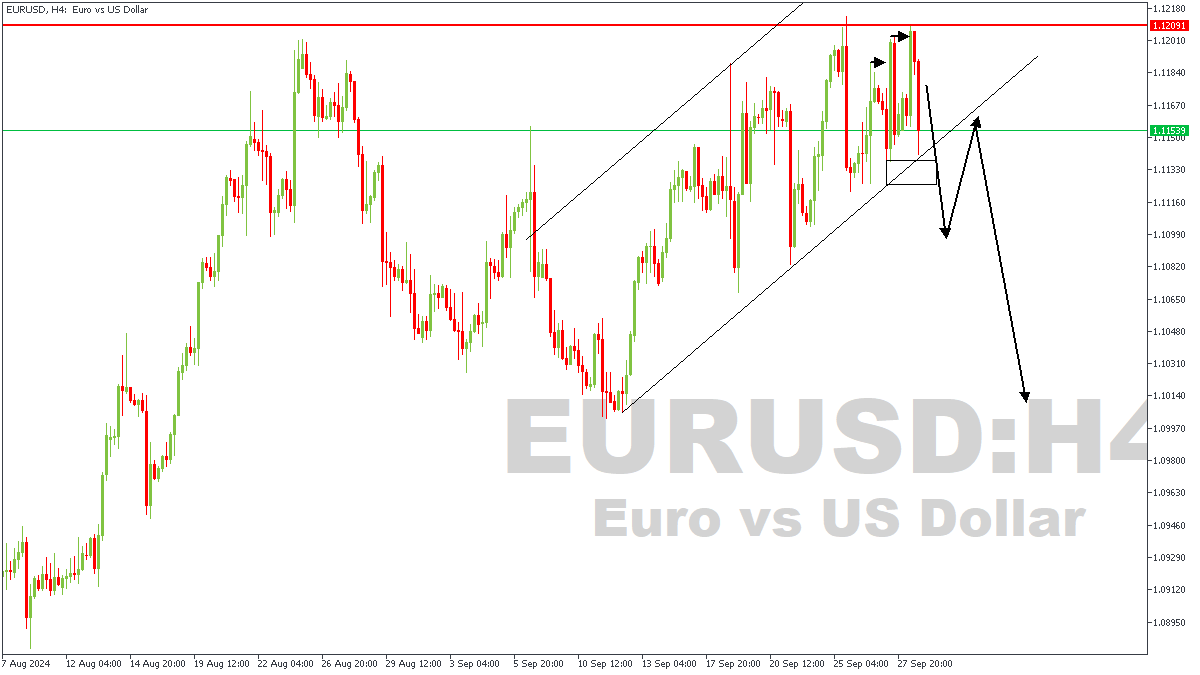

EURUSD– H4 Timeframe

The price on the 4-hour timeframe of EURUSD has recently come under heavy rejection from the daily timeframe pivot, leading to a suspicion that a bearish shift in market structure could be underway. The outcome is however going to depend on the ability of the momentum to break below the confluence region of the trendline support and the demand zone. What I mean is that if price can successfully break below the trendline and the demand zone, we would have confirmation of the bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 1.10460

Invalidation: 1.12033

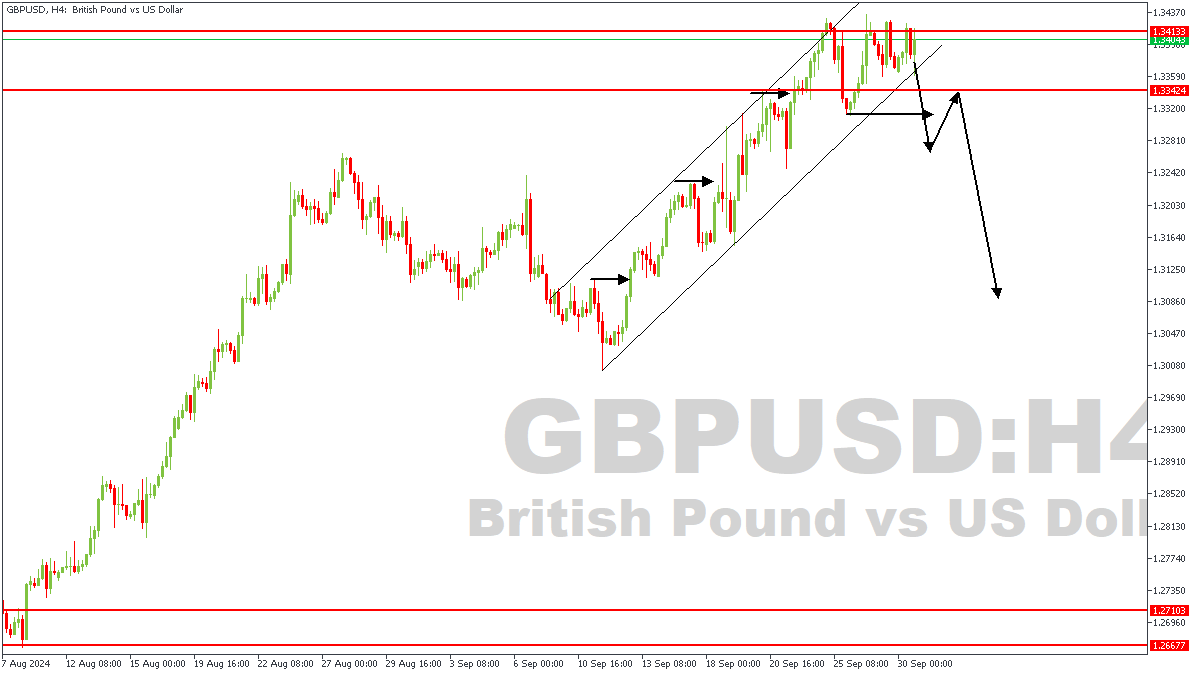

GBPUSD – H4 Timeframe

Price action on the 4-hour timeframe of GBPUSD closely mirrors what we have on the same timeframe chart of EURUSD. In the case of GBPUSD though, the rejection is coming from a pivot some within an area of imbalance on the weekly timeframe. The expected outcome is however the same. I’m looking forward to a break in the market structure, as well as the trendline as the requisite confluence for the bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 1.32176

Invalidation: 1.34414

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.