Technical Analysis

- Brent Crude: Up 0.44% to $72.48

- WTI Crude: Up 0.5% to $68.62

- Price Action: Oil remains rangebound, fluctuating as traders weigh supply risks against potential demand concerns.

Fundamental Factors Affecting Oil Prices

- U.S. Sanctions on Iran:

- New sanctions could remove up to 1 million barrels daily from the market.

- First U.S. measures targeting a Chinese refinery processing Iranian crude.

- OPEC+ Production Adjustments:

- OPEC+ will increase supply next month despite voluntary cuts.

- Seven OPEC+ nations to compensate for overproduction, potentially reducing overall supply in the near term.

- Ukraine War Ceasefire Talks:

- U.S. and Russian officials meeting in Saudi Arabia for negotiations.

- A potential ceasefire could ease supply constraints from Russia.

- Trump’s Trade Policy Flexibility:

- Comments on potential tariff relief eased market fears.

- The U.S. trade chief will hold discussions with China, impacting broader economic sentiment.

Key Takeaway for Traders

- Short-term: Oil prices may stay volatile as markets digest supply disruptions from Iran versus increased OPEC+ output.

- Medium-term: A Ukrainian ceasefire could increase Russian crude supply, pressuring prices.

- Long-term: Watch for further geopolitical developments and OPEC+ supply strategies, which will drive price action.

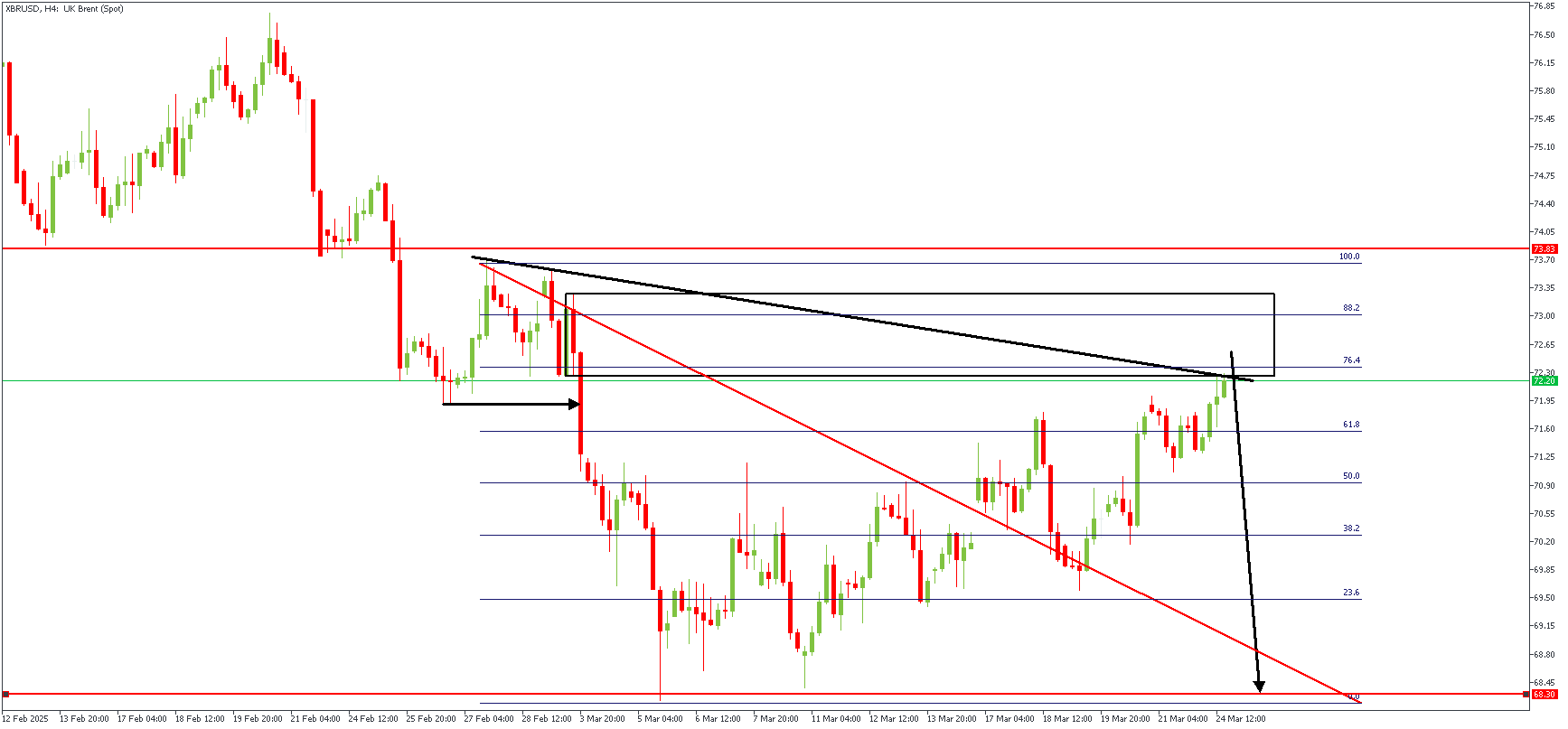

XBRUSD – H4 Timeframe

After breaking below the highlighted low, the price action on the 4-hour timeframe chart of XBRUSD began steadily climbing towards the rally-base-drop supply region that initiated the bearish break. The retracement has reached the 76% region of the Fibonacci retracement tool and is now under pressure from the trendline resistance and the supply zone.

XBRUSD – H2 Timeframe

.png)

The 2-hour timeframe chart of XBRUSD shows the FVG (Fair Value Gap) and the liquidity from the equal highs. The confluence of the trendline resistance, supply zone, and Fibonacci levels is the criterion for this bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target- 68.30

Invalidation- 73.83

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.