JPY Volatility Likely to Stay Elevated

- Japan's top negotiator, Ryosei Akazawa, is heading to Washington to push for the complete removal of U.S. tariffs, especially the 25% auto tariff, which affects a significant pillar of Japan's exports.

- These tariffs have already dented profits for Japanese firms, threatening Japan's growth outlook.

- USDJPY may stay under pressure as:

- Economic uncertainty reduces the likelihood of a BOJ rate hike from April 30th to May 1st.

- The BOJ's dovish tone and stronger U.S. inflation expectations could widen the rate differential again—unless U.S. growth also slows due to trade retaliation.

- Potential play: If tariffs escalate or no progress is made, the JPY could strengthen as risk sentiment sours (safe-haven flows). Conversely, signs of a deal could weaken the JPY as the BOJ stays dovish and growth stabilizes.

USD Outlook Clouded by Tariff Retaliation

- Trump's tariffs on China (145%) and Japan (25% on autos) have sparked retaliation — China raised its tariffs on U.S. goods to 125%.

- Global risk sentiment is fragile; safe-haven USD demand may rise short-term, but long-term confidence in the USD as a store of value is wobbling.

- DXY's reaction will depend on whether trade tensions escalate or de-escalate.

Risk Sentiment & Crosses

- Due to rising global protectionism, broad risk-off moves have hurt AUDUSD, NZDUSD, and emerging market FX.

- Any surprise BOJ rate cut or signs of U.S.-Japan trade progress could create short-term buying opportunities in JPY crosses like AUDJPY and EURJPY.

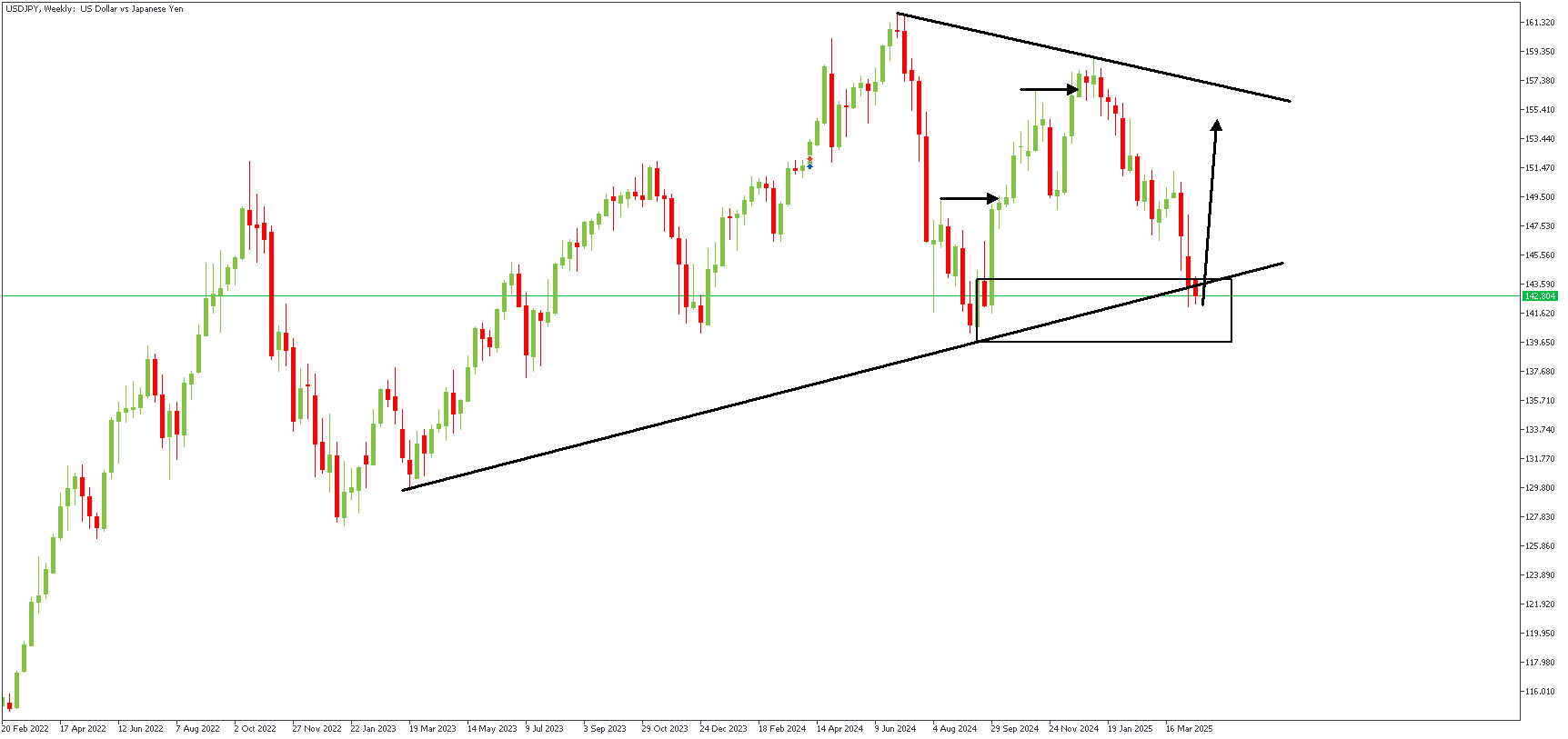

USDJPY – W1 Timeframe

Despite being confined within the wedge pattern, the price action on the weekly timeframe of USDJPY shows signs of a potential reversal from the highlighted demand area. The additional confluence from the trendline support and the internal bullish break of the structure provide a considerable argument in favor of the bullish sentiment.

USDJPY – D1 Timeframe

.png)

Interestingly, the daily timeframe chart of USDJPY seems to be printing an SBR (Sweep-Break-Retest) pattern. I expect a sweep of liquidity from the previously induced low, after which a bullish reaction from the demand zone would seem inevitable.

Analyst's Expectations:

Direction: Bullish

Target- 154.243

Invalidation- 139.187

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.