The forex market was relatively quiet during the Asian trading session, with only minor changes seen across currencies. There was a slight dip in commodity currencies due to weaker-than-expected manufacturing data from China, though this was somewhat balanced by better results from the Caixin PMI report. This week will be crucial as traders look for clues on the Fed’s upcoming decisions on interest rate cuts, with important economic data like the ISM indexes and non-farm payrolls expected to provide direction. Here is the prediction from our weekly live analysis on YouTube. Enjoy!

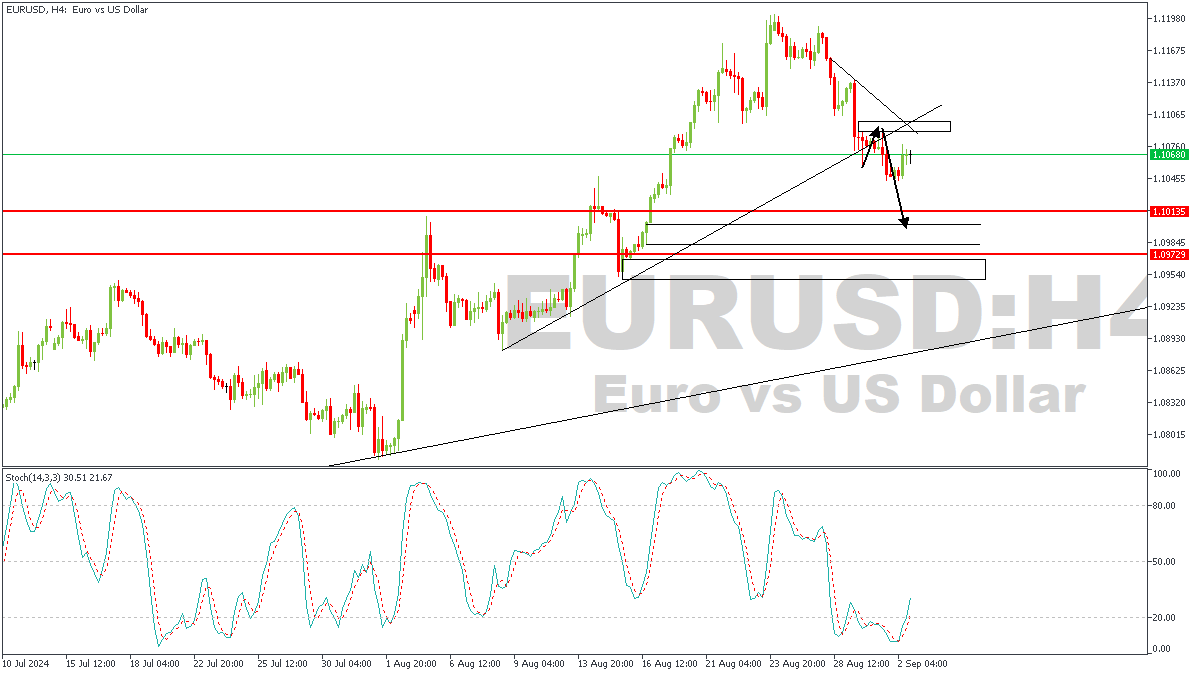

EURUSD– H4 Timeframe

EURUSD began a steady decline last week, followed by a stalling in the price action as price seeks to find its course ahead of the rates decision. This week, I expect to see a continuation of the bearish momentum since price has already broken below the previous structure, and trendline. The retest of the confluence region between the trendline resistance, and the supply zone is my priority entry region.

Analyst’s Expectations:

Direction: Bearish

Target: 1.10028

Invalidation: 1.10959

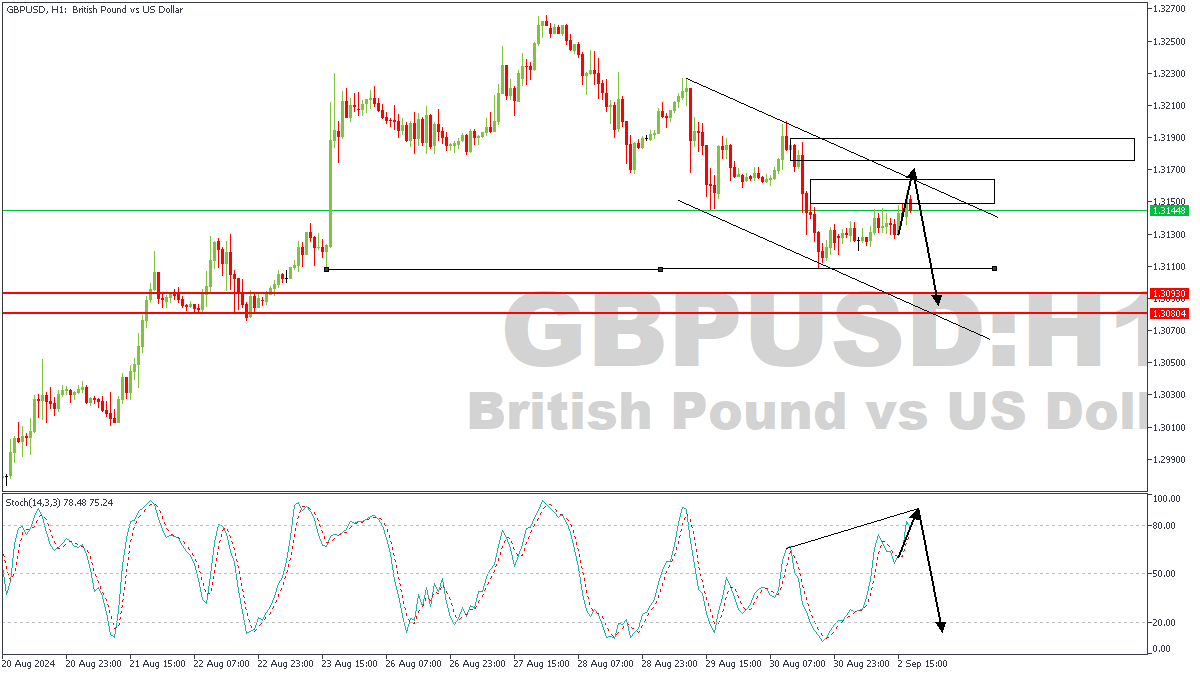

GBPUSD – H1 Timeframe

GBPUSD is currently trading within a descending channel, with the stochastic nearly completing a convergence pattern. This implies that the confluence of the supply zone and the trendline resistance can be expected to carry much more weight as a result of the stochastic confirmation. Ultimately, critical observation of the lower timeframe price action will determine the trigger point.

Analyst’s Expectations:

Direction: Bearish

Target: 1.31082

Invalidation: 1.31928

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.