.jpg)

งบลงทุนคืออะไร?

การจัดทำงบลงทุนเป็นกระบวนการในการเลือกโครงการตามผลตอบแทนจากการลงทุน

องค์กรมักเผชิญกับความท้าทายในการเลือกหลายๆโครงการที่น่าลงทุน องค์กรต้องการเลือกโครงการที่ทำกำไรทั้งหมดเป็นการลงทุน แต่เนื่องจากข้อจำกัดของเงินทุน องค์กรจึงต้องเลือกเพียงบางส่วนเท่านั้น

ในขณะที่องค์กรต่างๆพากันค้นหาโครงการที่ดีที่สุดในการลงทุน ผู้คนก็ทำการลงทุนกันอยู่ทุกวัน นั่นคือเหตุผลที่การจัดทำงบลงทุนนั้นเป็นแนวคิดที่ส่งผลต่อชีวิตประจำวันของเรา

ตัวอย่างเช่น แล็ปท็อปของคุณเสีย คุณจะซื้อใหม่หรือซ่อมตัวเก่าก็ได้ อาจมีความเป็นไปได้ที่แล็ปท็อปเครื่องใหม่จะมีราคาถูกกว่าการซ่อมแซมเครื่องเก่า ดังนั้น คุณจึงตัดสินใจเปลี่ยนแล็ปท็อปของคุณ แล้วดูเครื่องอื่นที่เหมาะกับงบประมาณของคุณ!

การทำงบลงทุนนั้นมีขั้นตอนอย่างไร

เป้าหมายหลักของการจัดทำงบลงทุนคือการพิจารณาว่าโครงการนั้นจะนำผลกำไรมาสู่บริษัทหรือไม่ วิธีดำเนินการถูกำไปปฏิบัติในวิธีต่างๆ ระยะเวลาคืนทุน (PB) อัตราผลตอบแทนภายใน (IRR) และมูลค่าปัจจุบันสุทธิ (NPV) นั้นเป็นวิธีการทั่วไป นอกจากนี้ บางองค์กรยังคำนวณดัชนีความสามารถในการทำกำไร, การวิเคราะห์ตัวเลือกจริง, เงินงวดประจำปีเทียบเท่า

ในสถานการณ์ในอุดมคติ วิธีการทั้งหมดเหล่านี้จะชี้ไปที่ผลลัพธ์เดียวกัน แต่ในความเป็นจริง ผลลัพธ์มักจะแตกต่างออกไปขึ้นอยู่กับความชอบของผู้บริหารและเกณฑ์การคัดเลือกซึ่งจะมีการเน้นที่วิธีหนึ่งมากกว่าอีกวิธี อย่างไรก็ตาม มีข้อดีและข้อเสียทั่วไปที่เกี่ยวข้องกับวิธีการประเมินมูลค่าเหล่านี้ที่ถูกนำไปใช้กันอย่างแพร่หลาย

ขั้นตอนทั่วไปในกระบวนการจัดทำงบลงทุน

1. ระบุและประเมินโอกาสที่เป็นไปได้

แต่ละบริษัทก็จะมีหลายโอกาสในการลงทุนให้พิจารณา ตัวอย่างเช่น บริษัทที่ผลิตสินค้าใดๆควรเลือกว่าจะส่งสินค้าทางเรือ, เครื่องบิน, หรือรถไฟไปให้ลูกค้า ด้วยเหตุนี้ แต่ละตัวเลือกจึงต้องได้รับการประเมินเพื่อดูว่าสิ่งใดเหมาะสมที่สุดทั้งในเรื่องการเงินและการขนส่ง เมื่อระบุโอกาสที่เป็นไปได้มากที่สุดแล้ว บริษัทควรกำหนดเวลาที่เหมาะสมในการดำเนินการ โดยคำนึงถึงปัจจัยต่างๆ เช่น ความต้องการของธุรกิจและค่าใช้จ่ายล่วงหน้า

2. ประมาณการต้นทุนการดำเนินงานและการใช้งาน

ขั้นตอนต่อไปคือการกำหนดต้นทุนของโครงการ กระบวนการนี้ต้องการการวิจัยทั้งภายในและภายนอก หากบริษัทกำลังพัฒนาทางเลือกด้านการขนส่ง ก็ควรเปรียบเทียบต้นทุนของการขนส่งด้วยตัวเองกับต้นทุนการขนส่งโดยใช้บริษัทอื่น หลังจากที่เลือกวิธีที่ราคาถูกที่สุดแล้ว มันอาจพยายามลดค่าใช้จ่ายในการใช้ตัวเลือกใดก็ได้ที่เลือกใช้ให้แคบลง

3. ประมาณการกระแสเงินสดหรือผลประโยชน์

ขั้นตอนต่อไปคือการกำหนดรายได้ที่โครงการใหม่สามารถสร้างได้

ตัวแปรแรกคือการตรวจสอบข้อมูลเกี่ยวกับโครงการคล้ายๆกันที่ประสบความสำเร็จ ในกรณีที่โครงการไม่สามารถสร้างเงินได้เอง บริษัทควรคำนวณจำนวนเงินที่โครงการนี้อาจประหยัดได้ และตัดสินใจว่าโครงการนี้คุ้มค่าที่จะทำหรือไม่

4. ประเมินความเสี่ยง

บริษัทจำเป็นต้องประเมินความเสี่ยงที่เกี่ยวข้องกับโครงการ ที่นี่บริษัทจำเป็นต้องตัดสินใจว่าพวกเขาพร้อมที่จะล้มโครงการและเสียเงินทั้งหมดแล้วนำค่าความเสียหายนั้นไปเปรียบเทียบรายได้ที่อาจเกิดขึ้นหรือไม่ ความล้มเหลวของโครงการไม่ควรทำให้กระบวนการทั้งหมดของผังการทำงานของบริษัทเสียหาย

5. การนำไปปฏิบัติ

หากบริษัทตัดสินใจที่จะทำ ก็ควรจะสร้างแผนโครงการขึ้นมา ซึ่งประกอบด้วยวิธีการชำระเงิน, วิธีติดตามต้นทุน, กระบวนการบันทึกกระแสเงินสดหรือผลประโยชน์ได้รับจากโครงการ แผนงานควรมีไทม์ไลน์ของโครงการพร้อมกำหนดเวลาเส้นตายด้วย

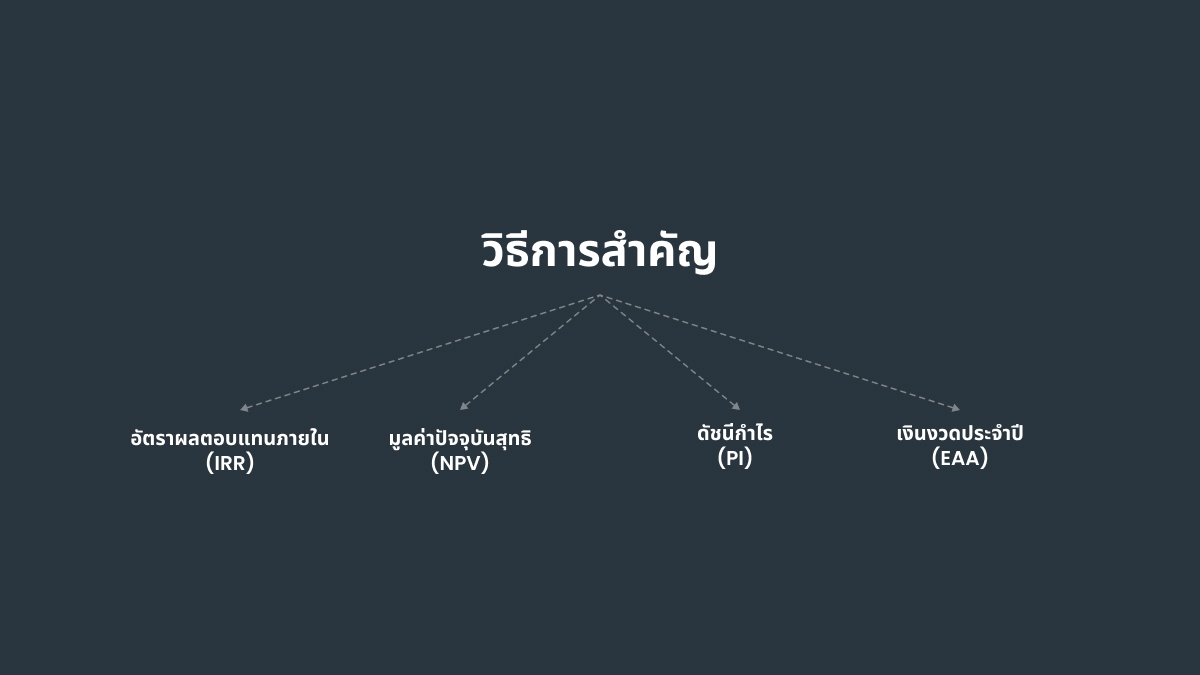

วิธีการหลักๆ

ระยะเวลาคืนทุน

ระยะเวลาคืนทุนเป็นระยะเวลาที่ต้องใช้ในการจ่ายคืนเงินทุนเริ่มต้นทั้งหมด ตัวอย่างเช่น หากโครงการต้องใช้เงินลงทุน 1 ล้านดอลลาร์ ระยะเวลาคืนทุนจะแสดงจำนวนปีที่กระแสเงินสดรับเข้าเพื่อให้ตรงกับกระแสไหลออก 1 ล้านดอลลาร์ ยิ่งระยะเวลาคืนทุนสั้นลงเท่าไหร่ โครงการนั้นก็ยิ่งน่าลงทุน

บริษัทมักจะใช้วิธีระยะเวลาคืนทุนเมื่อสภาพคล่องมีปัญหาร้ายแรง หากบริษัทมีเงินทุนจำกัด บริษัทสามารถจัดการกับโครงการหลักได้ครั้งละหนึ่งโครงการเท่านั้น ดังนั้น ฝ่ายบริหารจะให้ความสำคัญอย่างมากกับการคืนเงินลงทุนเริ่มแรกสำหรับโครงการต่อๆไป

มีข้อจำกัดหลายประการในการใช้วิธีการคืนทุน ประการแรก ระยะเวลาคืนทุนจะไม่คำนึงถึงมูลค่าของเงินตามเวลา (TVM)

ข้อเสียอีกประการหนึ่งคือกระแสเงินสดที่เกิดขึ้นเมื่อสิ้นสุดวงจรชีวิตของโครงการ เช่น มูลค่าคงเหลือที่ไม่รวมอยู่ในระยะเวลาคืนทุนและระยะคืนทุนปรับมูลค่าเงิน ดังนั้นระยะเวลาคืนทุนจึงไม่ใช่ตัวบ่งชี้การทำกำไรโดยตรง

อัตราผลตอบแทนภายใน

อัตราผลตอบแทนภายใน (IRR) คือวิธีการลดค่ากระแสเงินสดที่มาจากอัตราผลตอบแทนของโครงการ อัตราผลตอบแทนภายในคืออัตราลดค่าที่ผลรวมของต้นทุนเงินสดและเงินสดที่ได้รับที่เป็นศูนย์ กล่าวคือมันเป็นอัตราลดค่าที่มูลค่าปัจจุบันสุทธิ (NPV) เป็นศูนย์

หากโครงการต่างๆมีต้นทุนเท่ากัน บริษัทจะเลือกโครงการที่มี IRR สูงสุด เมื่อองค์กรต้องการเลือกระหว่างหลายโครงการที่มีมูลค่าเท่ากัน โครงการเหล่านี้จะถูกจัดวางโดยการวัด IRR แล้วเลือกโครงการที่ทำกำไรได้มากที่สุด ตามหลักการแล้ว บริษัทจะเลือก IRR ที่มีต้นทุนสูงกว่าต้นทุนเงินทุน

มูลค่าปัจจุบันสุทธิ

มูลค่าปัจจุบันสุทธิจะถูกคำนวณเป็นผลต่างระหว่างมูลค่าปัจจุบันของเงินสดรับกับมูลค่าปัจจุบันของเงินสดจ่ายในช่วงเวลาหนึ่ง บริษัทมักจะพิจารณาเฉพาะการลงทุนที่มี NPV ที่เป็นบวกเท่านั้น ในกรณีที่มีโครงการที่คล้ายคลึงกันหลายโครงการ โครงการที่มี NPV สูงกว่าก็จะถูกเลือก

NPV ได้รับผลกระทบอย่างมากจากอัตราลดค่า การเลือกอัตราที่เหมาะสมนั้นมีความสำคัญต่อการตัดสินใจที่ถูกต้อง สิ่งนี้ควรสะท้อนความเสี่ยงของการลงทุน ซึ่งโดยทั่วไปจะวัดจากความผันผวนของกระแสเงินสด และต้องคำนึงถึงส่วนประสมทางการเงินด้วย แนวทางปฏิบัติทั่วไปในการเลือกอัตราลดค่าสำหรับโครงการคือการใช้ WACC ที่ใช้กับทั้งบริษัท แต่อัตราลดต่าที่สูงกว่าอาจเหมาะสมกว่าเมื่อความเสี่ยงของโครงการสูงกว่าความเสี่ยงของบริษัทโดยรวม

ดัชนีการทำกำไร

ดัชนีความสามารถในการทำกำไร (PI) หรือที่เรียกว่าอัตราผลตอบแทนจากการลงทุน (PIR) และอัตราส่วนมูลค่าต่อการลงทุน (VIR) คืออัตราส่วนของผลตอบแทนจากการลงทุนต่อโครงการที่นำเสนอ มันเป็นเครื่องมือที่มีประโยชน์สำหรับการจัดอันดับโครงการเนื่องจากมันจะวัดปริมาณของมูลค่าที่สร้างขึ้นต่อหน่วยการลงทุน

เงินงวดประจำปี

วิธีเงินงวดประจำปีจะแสดง NPV เป็นกระแสเงินสดรายปีโดยหารด้วยมูลค่าปัจจุบันของปัจจัยเงินงวดประจำปี มันมักจะถูกใช้ในการเปรียบเทียบโครงการลงทุนที่มีอายุขัยไม่เท่ากัน ตัวอย่างเช่น หากโครงการ A มีอายุการใช้งานที่คาดไว้เจ็ดปี และโครงการ B มีอายุการใช้งานที่คาดไว้คือ 11 ปี มันคงจะไม่เหมาะสมที่จะเปรียบเทียบเพียงมูลค่าปัจจุบันสุทธิ (NPV) ของทั้งสองโครงการ เว้นแต่โครงการจะทำซ้ำไม่ได้

สรุป

การซื้อขายฟอเร็กซ์ก็สามารถถูกประเมินได้เหมือนโครงการลงทุน โดยเทรดเดอร์คือบริษัทขนาดใหญ่ที่มีเป้าหมายเพื่อให้มีเงินไหลเข้ามากกว่าเงินไหลออก

การซื้อขายโดยเจตนาด้วยกลยุทธ์ที่พัฒนามาอย่างดีคือกุญแจสู่ผลกำไรระยะยาวใน FOREX ไม่สำคัญว่าจะใช้วิธีใด คัดลอกคำสั่งซื้อ, บอตซื้อขาย, หรือซื้อขายด้วยตนเอง, เทรดเดอร์ทุกคนจะต้องเคารพการจัดการความเสี่ยงของเงินทุน

FBS มีตราสารให้คุณซื้อขายกว่า 1,000 รายการ รวมถึงสกุลเงินดิจิทัล, โลหะ, สกุลเงิน, และแม้แต่หุ้น เครื่องมือเหล่านี้ช่วยให้เทรดเดอร์แต่ละรายสามารถสร้างกลยุทธ์ที่ทำกำไรได้