ฉันหวังว่าทุกสินทรัพย์จะเป็นเหมือนสกุลเงินดิจิทัล ไม่ใช่เพราะว่าคริปโตสามารถกระโดดไปได้ถึง 100% ต่อวันและหลังจากนั้นก็ร่วงลงมาครึ่งหนึ่งของการพุ่งขึ้นทันทีหรอกนะ (แต่ก็ยังตลกอยู่ดีนะ) น่าเสียดาย สิ่งที่ยอดเยี่ยมอย่างหนึ่งที่สินทรัพย์ทั่วไปไม่มีก็คือการที่มันสามารถซื้อขายได้ทุกวันตลอด 24 ชั่วโมง ไม่เว้นวันหยุด ตราสาร Forex ส่วนใหญ่สามารถซื้อขายได้ในวันจันทร์-วันศุกร์ แล้วหุ้นล่ะ สามารถซื้อขายได้หลายชั่วโมงต่อวันไหม? ก็มีทั้งใช่และไม่ใช่นะ แต่ส่วนใหญ่ไม่ใช่ ในบทความนี้ คุณจะได้เรียนรู้เกี่ยวกับการซื้อขายล่วงหน้าและนอกเวลาทำการ:

- มันคืออะไร?

- ใครใช้มันได้บ้าง?

- มันดีกว่าการซื้อขายแบบคลาสสิกหรือเปล่า?

- และอื่นๆ อีกมากมาย!

การซื้อขายนอกเวลาทำการคืออะไร?

การซื้อขายนอกเวลาทำการเกิดขึ้นหลังจากวันซื้อขายแลกเปลี่ยนหุ้น และช่วยให้คุณสามารถซื้อหรือขายหุ้นนอกเวลาซื้อขายปกติได้ เรียกอีกอย่างว่า การขยายเวลาซื้อขาย

ตลาดก่อนและหลังชั่วโมงทำการก็ทำงานในลักษณะเดียวกับตลาดปกติ โดยจะมีการซื้อขายหุ้นระหว่างคู่สัญญาในราคาที่ตกลงกัน กล่าวอีกนัยหนึ่ง ราคาที่คุณจะได้รับคือราคาที่ผู้ที่อยู่ในตลาดนอกเวลาทำการหรือล่วงหน้าก่อนเวลาทำการของตลาดยินดีจ่าย

การซื้อขายหลังเวลาทำการช่วยให้นักลงทุนสามารถตอบสนองต่อการเปิดเผยผลประกอบการของบริษัทและข่าวอื่นๆ ที่มักเกิดขึ้นก่อนหรือหลังชั่วโมงซื้อขายปกติ ตัวอย่างเช่น ราคาอาจแกว่งไปมาอย่างรุนแรงจากการเปิดเผยผลประกอบการหรือข่าวที่ CEO กำลังก้าวลงจากตำแหน่ง ดังนั้น หากคุณต้องการซื้อหรือขายโดยเร็วที่สุดตามข่าว คุณจะต้องส่งคำสั่งซื้อขายหลังเวลาทำการ

ช่วงของการซื้อขายนอกเวลาทำการ

มีช่วงขยายเวลาการซื้อขายอยู่สองสามช่วงด้วยกัน:

- ช่วงก่อนเปิดทำการ ตั้งแต่ 4:00 ถึง 9:30 น. ตามเวลา ET

- ช่วงเวลาทำการ ตั้งแต่ 9:30 น. ถึง 16:00 น. ตามเวลา ET

- ช่วงนอกเวลาทำการ ตั้งแต่ 16:00 น. ถึง 20:00 น. ตามเวลา ET

ไม่ใช่ทุกโบรกเกอร์ซื้อขายที่จะอนุญาตให้เข้าถึงการซื้อขายก่อนและหลังเวลาทำการ และไม่ใช่ว่าทุกโบรกเกอร์จะอนุญาตให้คุณซื้อขายทั้งก่อนและหลังเวลาทำการของตลาดได้ ตัวอย่างเช่น โบรกเกอร์บางรายให้โอกาสคุณในการซื้อขายเพียงหนึ่งชั่วโมงก่อนตลาดเปิดและหนึ่งชั่วโมงหลังจากที่ตลาดปิด เงื่อนไขจะแตกต่างกันไปและขึ้นอยู่กับข้อบังคับ (และโบรกเกอร์ต้องการทำอย่างที่พวกเขาต้องการ)

ใครบ้างที่สามารถซื้อขายหลังเวลาทำการได้?

การซื้อขายนอกเวลาทำการเริ่มประมาณในปี 1999 ในเวลานั้น ตลาดหลักทรัพย์ส่วนใหญ่แนะนำเครือข่ายการสื่อสารทางอิเล็กทรอนิกส์ (ECN – ฟอรัมคอมพิวเตอร์ประเภทหนึ่งหรือเครือข่ายที่อำนวยความสะดวกในการซื้อขายผลิตภัณฑ์ทางการเงินนอกตลาดหลักทรัพย์แบบดั้งเดิม) ด้วย ECN เทรดเดอร์และนักลงทุนไม่จำเป็นต้องทำการออกออเดอร์โดยตรงในอาคารตลาดหลักทรัพย์

ในปัจจุบัน ผู้เข้าร่วมตลาดส่วนใหญ่ใช้ช่วงการซื้อขายที่แบบขยายเพื่อตอบสนองต่อข่าวได้เร็วกว่าคนอื่นๆ ตัวอย่างของข่าวดังกล่าว ได้แก่

- รายงานผลประกอบการ

- การเปลี่ยนแปลงอันดับเครดิต (โดยทั่วไปแล้ว ธนาคารรายใหญ่และหน่วยงานจัดอันดับจะเปิดเผยการประมาณการก่อนตลาดเปิด)

- เหตุการณ์ที่เกิดขึ้นกะทันหัน

สิ่งที่เราสามารถพูดได้อย่างแน่นอนคือการซื้อขายก่อนและหลังเวลาทำการมีให้เฉพาะสำหรับเทรดเดอร์ที่เทรดหุ้นและเฉพาะกับโบรกเกอร์บางรายเท่านั้น โบรกเกอร์ CFD เสนอทางเลือกนี้ให้น้อยลงเนื่องจากกฎระเบียบข้อบังคับและมาตรการด้านความปลอดภัย

สำหรับผู้เล่นรายใหญ่ ช่วงเวลาที่ขยายเพิ่มนี้เป็นเวลาที่สมบูรณ์แบบสำหรับเงินที่ชาญฉลาดในการดำเนินการ ตัวอย่างเช่น คนวงในและกองทุนป้องกันความเสี่ยงมักใช้เวลาซื้อขายก่อนและหลังชั่วโมงเพื่อดำเนินการตามคำสั่งซื้อของพวกเขาผ่านสิ่งที่เรียกว่า ตลาดมืด (dark pools; การแลกเปลี่ยนที่จัดขึ้นโดยส่วนตัวเพื่อการซื้อขายหลักทรัพย์) Dark pools ช่วยให้นักลงทุนสถาบันสามารถซื้อขายได้โดยไม่ต้องเปิดเผยจนกว่าจะมีการดำเนินการซื้อขายและการรายงาน

ความเสี่ยงของการซื้อขายนอกเวลาทำการ

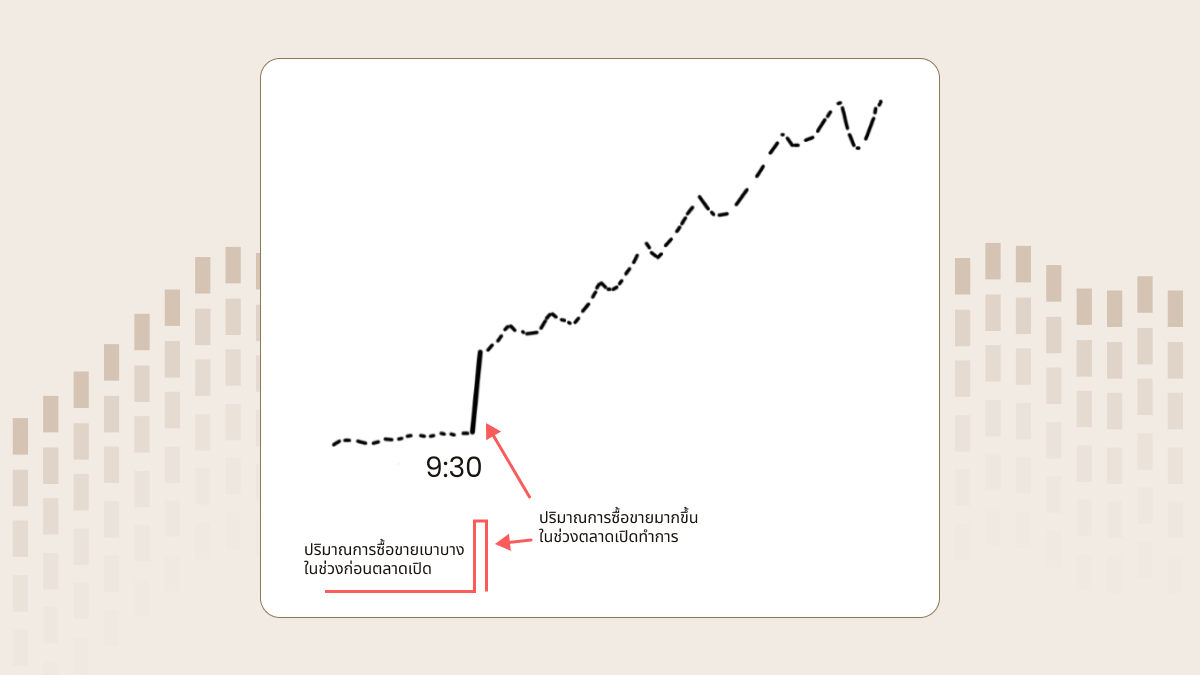

เนื่องจากมีผู้เข้าร่วมน้อยกว่าในช่วงเวลาซื้อขายปกติ ตลาดก่อนและหลังเวลาทำการโดยทั่วไปจะมีสภาพคล่องน้อยกว่า ผันผวนมากขึ้น และปริมาณการซื้อขายที่ต่ำกว่า ซึ่งอาจส่งผลกระทบอย่างมากต่อราคาที่ผู้ซื้อหรือผู้ขายได้รับสำหรับหุ้นของตน ดังนั้นจึงควรที่จะใช้คำสั่งจำกัดในหุ้นที่ซื้อหรือขายนอกเวลาซื้อขายปกติ

มันอาจจะช่วยได้หากคุณคำนึงถึงความเสี่ยงด้านราคาด้วย สถาบันการเงินต่างๆ ใช้ ECN หลายรายการในการดำเนินการซื้อขาย คำสั่งของคุณจะได้รับการดำเนินการด้วยราคาที่ดีที่สุดจากแหล่งที่มาต่างๆ ระหว่างช่วงการซื้อขายปกติ แต่ในช่วงขยายเวลา มีเพียงโบรกเกอร์รายเดียวเท่านั้นที่คุณสามารถซื้อขายได้ ดังนั้นราคาอาจจะแย่กว่าแหล่งอื่นๆ อย่างไรก็ตาม ค่าสเปรดระหว่างโบรกเกอร์อาจกลายเป็นโอกาสในการซื้อขายเก็งกำไร แต่เราจะอธิบายเพิ่มเติมเกี่ยวกับพวกเขาในภายหลัง

แน่นอน การซื้อขายนอกเวลาทำการจะมีผู้เข้าร่วมตลาดน้อยลง ดังนั้น คำสั่งซื้อขายที่น้อยลงจะถูกวางบนตารางความลึกของตลาด (market depth table) เมื่อทุกคนพยายามที่จะตอบสนองต่อรายการข่าวทั้งหมดในคราวเดียว หุ้นจะซื้อขายอย่างดุเดือดในช่วงหลังเวลาทำการ เนื่องจากตลาดทำงานเพื่อแยกแยะข่าวและค้นพบราคาใหม่เพื่อที่จะรักษาความปลอดภัย ด้วยเหตุนี้ นักลงทุนรายย่อยจึงอาจดำเนินการสั่งซื้อขายในราคาที่เลือกได้ยากขึ้น นอกจากนี้ คุณอาจได้ราคาที่ดีขึ้นในช่วงการซื้อขายปกติในวันถัดไปก็ได้

ประโยชน์ของการซื้อขายนอกเวลาทำการ

ประการแรกเลย ช่วงขยายเวลาเสนอโอกาสให้คุณเทรดตามข่าวก่อนคนอื่นๆ การเข้าซื้อกิจการ การควบรวมกิจการ การยื่นล้มละลาย รายงานของรัฐบาลเกี่ยวกับการว่างงาน และเหตุการณ์อื่น ๆ สามารถย้ายหุ้นก่อน (หรือหลัง) เสียงกระดิ่งของเวลาเปิดทำการดังขึ้นได้ จากนั้นคุณจะต้องตอบสนองอย่างรวดเร็วเพื่อจับการเคลื่อนไหวให้ทัน

และอย่าลืมเกี่ยวกับการเก็งกำไร มันเป็นรูปแบบการซื้อขายซึ่งรวมถึงการค้นหาความแตกต่างของราคาในสินทรัพย์เดียวกันในโบรกเกอร์ต่างๆ โดยปกติราคามักจะสอดคล้องกัน (เพราะเป็นสินทรัพย์เดียวกัน ทำไมมันถึงแตกต่างกันด้วยนะ?) นักเก็งกำไรชอบที่จะช่วงเวลาขยาย เพราะเป็นช่วงเวลาเดียวในตลาดหุ้นที่การเก็งกำไรสามารถดำรงอยู่ได้นานกว่าเสี้ยววินาที

โดยสรุป การซื้อขายล่วงหน้าและนอกเวลาทำการก็มีทั้งข้อดีและข้อเสีย ด้วยความเข้าใจเกี่ยวกับช่วงเวลาขยายและวิธีการใช้งาน คุณอาจพบโอกาสในการซื้อขายใหม่ๆ ก็ได้นะ แต่ก็ให้ระมัดระวังความเสี่ยงต่างๆ ให้ดี Trade safely, good luck!