ความสำคัญของอัตราส่วนความเสี่ยงต่อผลตอบแทน

มันก็ยุติธรรมดีที่จะบอกว่าอัตราส่วนความเสี่ยง/ผลตอบแทนเป็นหนึ่งในสิ่งที่สำคัญที่สุดที่คุณควรใช้หากคุณต้องการเป็นเทรดเดอร์ที่ประสบความสำเร็จ มันจะช่วยคุณในการคำนวณความสูญเสียและผลกำไรของคุณ และให้เหตุผลอีกประการหนึ่งที่คุณควรคิดให้รอบคอบก่อนเปิดคำสั่งซื้อ จะเป็นการดีที่สุดถ้าคุณไม่พึ่งพาอัตราส่วน R/R แบบสากลในการตัดสินใจซื้อขายของคุณ สำหรับทุกๆคำสั่งซื้อ คุณควรกำหนดว่าคุณสามารถเสียได้มากแค่ไหนในแต่ละคำสั่งซื้อ และกำหนดจำนวนที่คุณสามารถสูญเสียได้ในวันนี้ก่อนที่คุณจะเสร็จสิ้นการเทรดของคุณ

หากคุณเห็นการซื้อขายที่ดูน่าสนใจเนื่องจากรูปแบบของราคา, ภูมิหลังทางเศรษฐกิจ, หรือความรู้สึกภายในของคุณ คุณสามารถรับความเสี่ยงเพิ่มขึ้นได้ และใช้อัตราส่วนความเสี่ยง/ผลตอบแทน 1:2, 1:1 หรือแม้แต่ 1: 0.5 มันไม่เป็นไรเลย ตราบใดที่คุณเข้าใจถึงเหตุผลที่คุณเปิดคำสั่งซื้อ และสามารถควบคุมอารมณ์ของคุณได้ นอกจากนี้ ยิ่งคุณมีอัตราส่วน R/R น้อยแค่ไหน (1:3 ไม่ได้น้อยเกินไป แต่ 1:5 เป็นอัตราส่วน R/R ที่น้อย) โอกาสที่คุณจะได้กำไรจากการซื้อขายก็จะยิ่งน้อยลงเท่านั้น มันเกิดขึ้นเนื่องจากความผันผวนของตลาดที่สามารถพากราฟไปชน Stop Loss ของคุณแล้วค่อยย้อนกลับไปยังเป้าหมายของคุณ มันจะช่วยได้มากๆหากคุณพบสมดุลระหว่างอัตราส่วน R/R และอัตราการชนะของการเทรดเพื่อให้ประสบความสำเร็จ

ทุกกิจการในตลาดที่เกี่ยวข้องกับผลตอบแทนใดๆต้องการความเสี่ยงจำนวนหนึ่ง หลีกเลี่ยงการตัดสินใจด้วยอารมณ์เพราะมันสามารถเปลี่ยนเป้าหมายทางการเงินที่ตั้งไว้ล่วงหน้าของคุณแล้วหลอกล่อให้คุณทำการเดิมพันที่ไม่สอดคล้องกัน มันจำเป็นเสมอที่จะต้องมีอัตราส่วนความเสี่ยงต่อผลตอบแทนเพื่อรับความเสี่ยงตามที่ถูกคำนวณเอาไว้ล่วงหน้าแล้ว

วิธีการคำนวณอัตราส่วนความเสี่ยง/ผลตอบแทน

ในการคำนวณอัตราส่วนความเสี่ยง/ผลตอบแทน ให้เริ่มต้นด้วยการหาทั้งความเสี่ยงและผลตอบแทน ทั้งสองระดับนี้เทรดเดอร์จะเป็นผู้กำหนด

ความเสี่ยงคือจำนวนเงินที่คุณสามารถสูญเสียในการซื้อขายได้ อย่าลงมืออย่างสุ่มสี่สุ่มห้าโดยวางคำสั่ง Stop Loss ไว้ที่แบบสุ่มๆบนกราฟเพียงเพื่อจะรักษาอัตราส่วน R/R ระดับ Stop Loss และ Take Profit นั้นมีความสำคัญมากกว่าอัตราส่วนความเสี่ยง/ผลตอบแทน เนื่องจากมันจะเป็นตัวกำหนดว่าการซื้อขายมีโอกาสที่จะประสบความสำเร็จหรือไม่

รางวัลคือเงินที่คุณได้รับเมื่อคำสั่งซื้อไปถึงระดับ Take Profit เช่นเดียวกับความเสี่ยง อย่าวางระดับ Take Profit ของคุณไว้แบบสุ่มๆบนกราฟเพื่อให้ได้อัตราส่วน R/R ที่ต้องการ บางครั้ง การมีอัตราส่วน R/R ที่เล็กกว่าแต่มีอัตราการชนะที่สูงกว่านั้นจะดีกว่า

มีสูตรอัตราส่วนความเสี่ยงต่อผลตอบแทนอย่างง่ายที่คุณสามารถใช้คำนวณอัตราส่วนได้

อัตราส่วนความเสี่ยง/ผลตอบแทน (อัตราส่วน R/R) = (จุดเข้า - จุดหยุดการขาดทุน) / (จุดทำกำไร - จุดเข้า)

ตัวอย่างเช่น หากคุณเข้าซื้อ XAUUSD โดยเข้าที่ราคา $1,800 แล้ววาง Stop Loss ไว้ที่ $1750 และเป้าหมายกำไรที่ $2000 อัตราส่วนความเสี่ยง/ผลตอบแทนคือ:

(1800 - 1750) / (2000 - 1800) = 50 / 200 = 1:4 (0.25)

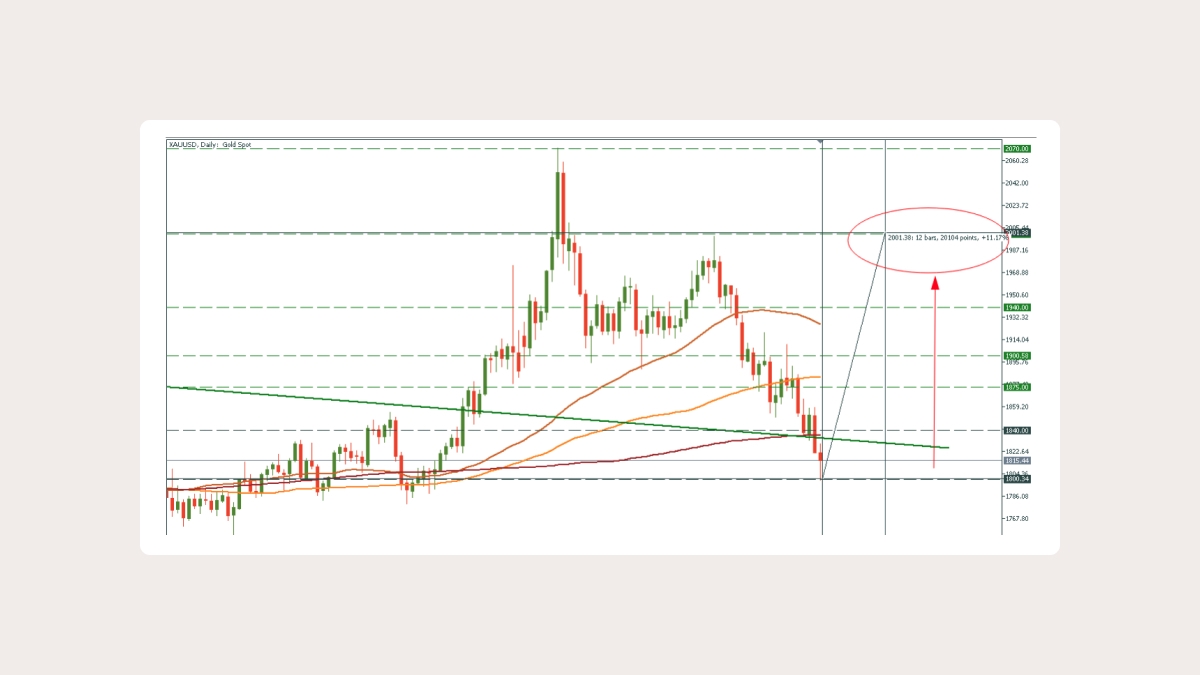

นอกจากนี้ คุณยังสามารถคำนวณอัตราส่วน R/R ด้วยจุดราคาได้ เปิดกราฟบน Meta Trader 4/5 แล้วคลิกล้อเลื่อนของเมาส์ เป้าเล็งจะปรากฏขึ้น และตอนนี้คุณสามารถคลิกและลากเคอร์เซอร์เพื่อค้นหาจุดกำไรหรือขาดทุนได้

จากนั้นเลื่อนเคอร์เซอร์ลง และคุณจะได้รับจุดขาดทุนที่เป็นไปได้

เรามีการสูญเสียที่เป็นไปได้ 5,000 จุดและรางวัล 20,000 จุด ดังนั้น อัตราส่วนความเสี่ยง/ผลตอบแทนคือ 4000 / 20 000 = 1:4 (0.25)

ตัวอย่างอัตราส่วนความเสี่ยงต่อผลตอบแทน

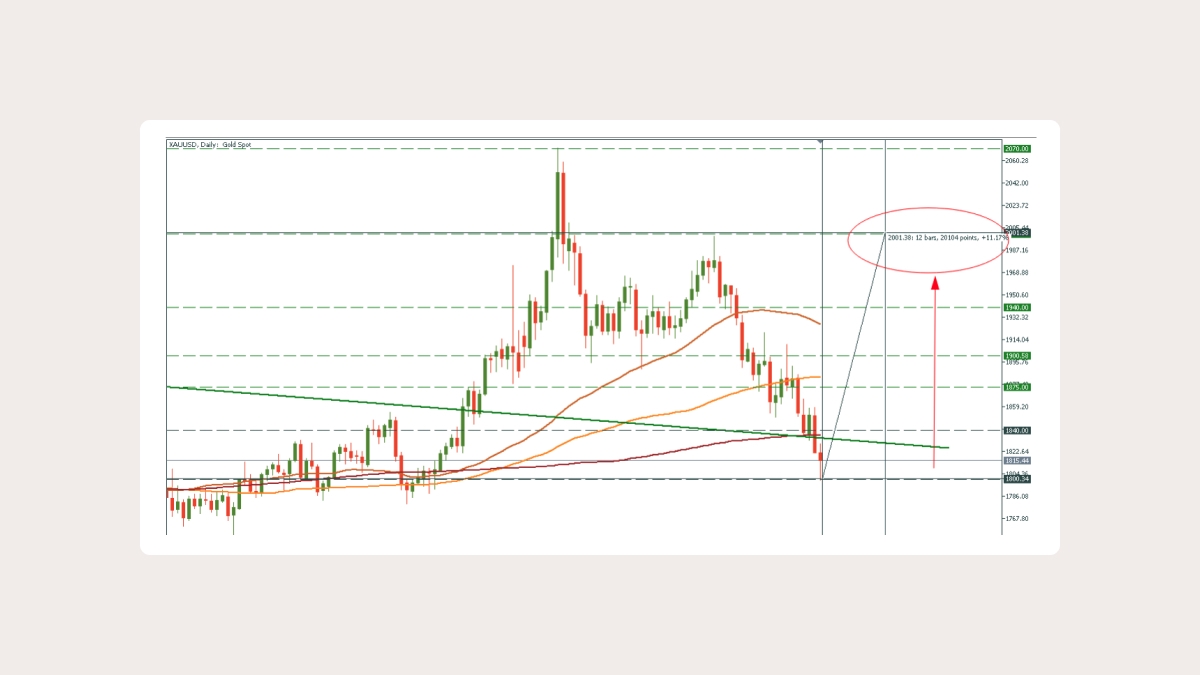

อันดับแรก คุณต้องมองหาการซื้อขายที่ดึงดูดความสนใจของคุณ เราจะใช้กราฟ XAUUSD (ทองคำ) เพื่อทำให้อธิบายได้ง่ายขึ้น เราพบ divergence ใน RSI และสันนิษฐานว่าทองคำน่าจะพุ่งขึ้น ดังนั้น ก่อนเปิดคำสั่งซื้อ เราต้องกำหนด Stop Loss ของเราก่อน เราควรวางมันไว้ที่ไหน? โดยปกติควรวางไว้ใต้แนวรับ แต่เราจะขยับให้ไกลขึ้นเพื่อให้ปลอดภัยมากขึ้น แนวรับที่ดีอยู่ที่ $1,800 ดังนั้น Stop Loss ของเราจะอยู่ที่ระดับ $1790

ในกรณีของการเทรดด้วย RSI จุดทำกำไรของเราควรอยู่ใกล้แนวต้านที่ใกล้ที่สุด ซึ่งก็คือ $1833 เราจะปรับจุด Take Profit ให้ใกล้ขึ้นอีกนิดเพื่อให้มั่นใจ ผลลัพธ์อยู่บนหน้าจอของคุณ

จากนั้น เราต้องคำนวณอัตราส่วน R/R ในการเทรดนี้ อัตราส่วนความเสี่ยง/ผลตอบแทนคือ:(1800 - 1790) / (1830 - 1800) = 10 / 30 = 1:3 (0.33)

การซื้อขายที่ดีและมีระเบียบ ตอนนี้เราสามารถเปิดตำแหน่งของเราและรอให้โดนเป้าหมาย

อัตราส่วนความเสี่ยง/ผลตอบแทนที่ดีคืออะไร?

เทรดเดอร์ส่วนใหญ่จะพิจารณาอัตราส่วน 1:3 R/R เนื่องจากมันดีที่สุดสำหรับเทรดเดอร์ทุกคน เราไม่เห็นด้วยเพราะบางครั้งอัตราส่วน R/R เล็กๆนั้นจะหมายถึงอัตราการชนะที่ต่ำกว่า ดังนั้น หากคุณใช้อัตราส่วนความเสี่ยง/ผลตอบแทน 1:1 คุณมีโอกาสทำกำไรสูงกว่าการใช้อัตราส่วนความเสี่ยง/ผลตอบแทน 1:4 สิ่งนี้เกิดขึ้นเนื่องจากความผันผวนของตลาดและความผันผวนแบบสุ่มที่อาจทำให้ราคาแกว่งไปโดน Stop Loss ของคุณก่อนที่จะถึงระดับ Take Profit

ในกรณีส่วนใหญ่ ให้พยายามรักษาอัตราส่วน R/R ไว้ระหว่าง 1:1.5 ถึง 1:3 ด้วยวิธีนี้ คุณจะได้รับสิ่งที่ดีที่สุดจากสองโลก: อัตราส่วนที่เหมาะสมเพื่อช่วยคุณในการซื้อขาย และไม่มีความเสี่ยงเพียงพอที่อาจทำให้ชุดคำสั่งซื้อที่ไม่ดีที่ส่งผลทำให้พอร์ตแตก

สรุป

อัตราส่วนความเสี่ยงต่อผลตอบแทน (อัตราส่วน R/R) จะวัดรายได้และขาดทุนที่คาดหวังในการลงทุนและการซื้อขาย หากผลลัพธืมากกว่า 1.0 นั่นหมายถึงความเสี่ยงมีมากกว่าผลตอบแทน หากผลลัพธ์น้อยกว่า 1.0 นั่นหมายถึงความเสี่ยงมีมากกว่าผลตอบแทน ใช้มันอย่างชาญฉลาด แล้วคุณจะปรับปรุงผลการซื้อขายของคุณได้ในอีกไม่ช้า ขอให้มีความสุขในการเทรดกับ FBS!

.jpg)