หนึ่งในคำถามที่ถามบ่อยที่สุดในการสัมมนาออนไลน์ของเราคือ "ฉันจะเลือกกรอบเวลาสำหรับการซื้อขายได้อย่างไร?" บทความนี้จะกล่าวถึงปัญหานี้!

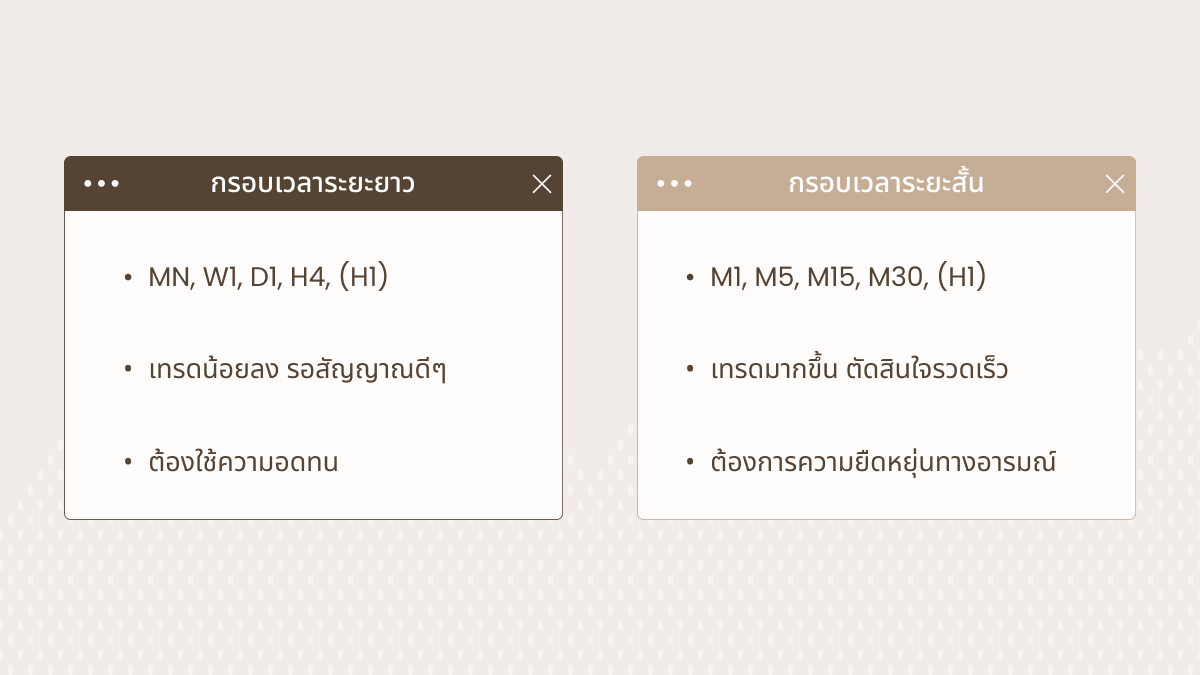

ขั้นแรกเราต้องแยกความแตกต่างระหว่างกรอบเวลาที่เรียกว่า "สูงกว่า" และ "ต่ำกว่า" เส้นแบ่งของพวกมันคือกรอบเวลาหนึ่งชั่วโมง (H1) กรอบเวลาที่มีระยะเวลามากกว่านี้จะเป็นกรอบเวลาที่สูงหรือใหญ่ (กรอบเวลา 4 ชั่วโมง, รายวัน, รายสัปดาห์, รายเดือน) ในขณะที่กรอบเวลาที่มีระยะเวลาน้อยกว่าจะเป็นกรอบเวลาที่ต่ำหรือเล็ก (กรอบเวลา 30 นาที, 15 นาที, 5 นาที)

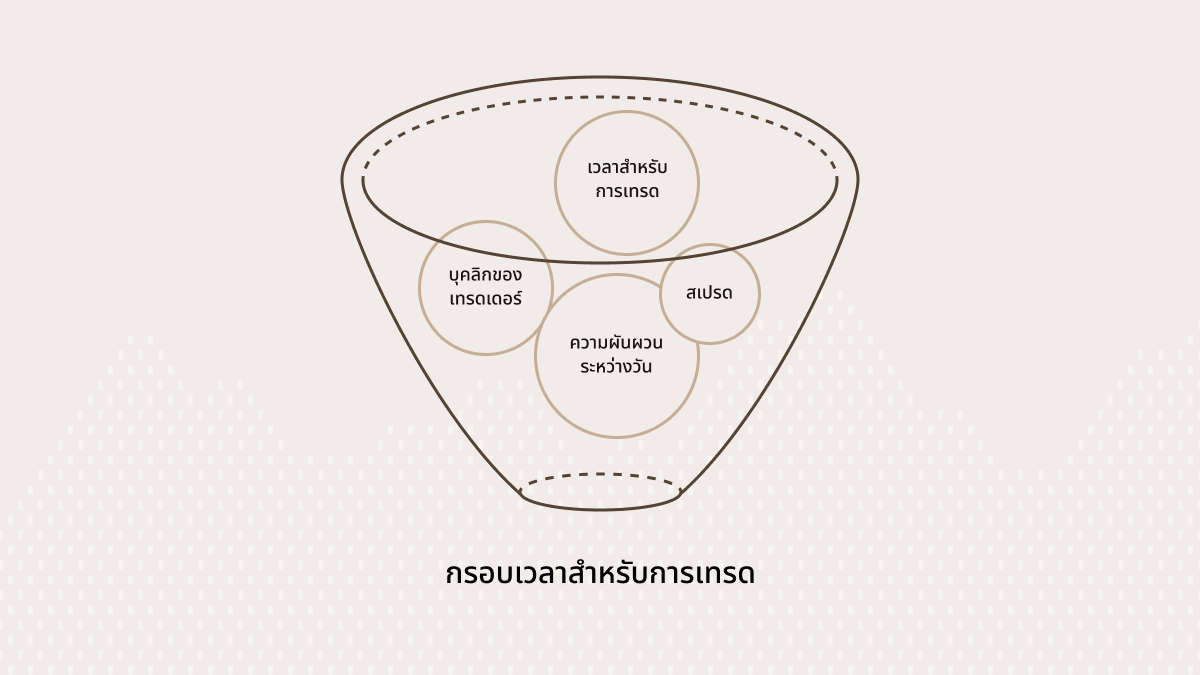

ปัจจัยที่มีผลต่อการเลือก

เวลาที่คุณมีไว้สำหรับการซื้อขาย

เวลาที่คุณต้องการใช้ในการซื้อขายถือเป็นปัจจัยหลัก หากคุณต้องการทำการซื้อขายจำนวนมากในหนึ่งวันให้เลือกกรอบเวลาที่เล็กกว่าและเป็น scalper หรือไม่ก็ day trader หากคุณไม่สามารถเป็น full-time trader ได้และวางแผนที่จะซื้อขายไม่เกิน 1-3 ครั้งต่อสัปดาห์ ให้เลือกกรอบเวลาที่ใหญ่กว่า มันง่ายใช่ไหมล่ะ? พนันได้เลย!

กรอบเวลาแต่ละแบบมีข้อดีของมัน กรอบเวลาที่สูงกว่าสามารถช่วยคุณลด "เสียงรบกวนในตลาด" และจับความผันผวนของราคาที่มีขนาดใหญ่และ "น่าลิ้มลอง" ได้ ในเวลาเดียวกันคุณอาจทำการซื้อขายได้มากขึ้นในกรอบเวลาที่ต่ำกว่า สิ่งนี้จะช่วยให้คุณสามารถสร้างรายได้ด้วยการพึ่งพาความน่าจะเป็นที่ว่า: ยิ่งเปิดการซื้อขายมากเท่าใดโอกาสที่คุณจะมีการซื้อขายที่ดีก็ยิ่งมากขึ้นเท่านั้น

บุคลิกภาพของคุณ

เมื่อทำการซื้อขายคุณควรจะต้องรู้สึกสบายใจ วิเคราะห์ข้อดีและข้อเสียของตัวคุณเและใช้พวกมันให้เป็นประโยชน์

หากคุณพร้อมที่จะทำการซื้อขายที่มีความเคร่งเครียดและความกดดันสูงขึ้นและต้องทำการตัดสินใจที่รวดเร็วคุณสามารถเลือกที่จะซื้อขายในกรอบเวลาที่ต่ำกว่าได้ คุณจะต้องเป็นคนที่ใจเย็น ฟื้นตัวได้อย่างรวดเร็วเมื่อประสบกับการสูญเสียและไม่หลงกลลวงไปตอบโต้กับตลาดหลังจากคุณเกิดการสูญเสีย นอกจากนี้คุณยังต้องรู้จักควบคุมอารมณ์เมื่อได้รับผลกำไรมหาศาลเพื่อไม่ให้คุณเคลิ้มและเริ่มเดิมพันมากเกินไปในคราวเดียว การซื้อขายระยะสั้นในกรอบเวลาที่ต่ำกว่าจะทำให้คุณรู้สึกถึงการเคลื่อนไหวของตลาดและจะทำให้คุณเป็นเทรดเดอร์ที่ตื่นตัว

เรียนรู้วิธีเทรดอย่างชาญฉลาด ทำเงินได้มากขึ้น และเสี่ยงน้อยลง