ความเสี่ยงและข้อจำกัดของการใช้แชตบอต AI ในการเทรด

พึ่งพาเทคโนโลยีมากเกินไป

หนึ่งในความเสี่ยงที่สำคัญที่สุดของการใช้แชตบอต AI ในการเทรดก็คือการพึ่งพาเทคโนโลยีมากเกินไป

ปัญหาและข้อผิดพลาดทางเทคนิค

ความเสี่ยงอีกประการหนึ่งของการใช้แชตบอต AI ในการเทรดคือปัญหาทางเทคนิคและข้อบกพร่องที่อาจส่งผลต่อความแม่นยำและความน่าเชื่อถือของระบบ

ข้อมูลที่เชื่อถือได้มีจำกัด

แชตบอตอาศัยข้อมูลเพื่อสร้างข้อมูลเชิงลึกและคำแนะนำ และการมีข้อมูลที่เชื่อถือได้อาจเป็นเรื่องท้าทายสำหรับบางตลาด

ข้อกังวลด้านความเป็นส่วนตัวและความปลอดภัย

สุดท้ายนี้ ความกังวลเกี่ยวกับความเป็นส่วนตัวและความปลอดภัยมีความเกี่ยวข้องกับการใช้แชตบอต AI ในการเทรด เทรดเดอร์ควรตรวจสอบให้แน่ใจว่าบัญชีซื้อขายและข้อมูลส่วนตัวของพวกเขามีความปลอดภัย

ข้อควรระวังด้านกฎระเบียบและการปฏิบัติตามข้อบังคับ

ตรวจสอบกฎของโบรกเกอร์ของคุณเกี่ยวกับการอัตโนมัติก่อนเชื่อมต่อบอตหรือสคริปต์

ใช้เฉพาะแหล่งข้อมูลและ API ที่ได้รับการอนุมัติจากโบรกเกอร์หรือเอ็กซ์เชนจ์ของคุณเท่านั้น

ปฏิบัติตามกฎหมายท้องถิ่นและข้อกำหนดการออกใบอนุญาตที่ใช้กับกิจกรรมการเทรดของคุณ

โปรดตรวจสอบและเคารพข้อกำหนดในการให้บริการของแพลตฟอร์มก่อนดำเนินการกลยุทธ์อัตโนมัติ

รายการตรวจสอบความปลอดภัยและการปกป้องข้อมูล:

– ใช้ API keys แบบอ่านอย่างเดียว (read-only)

– แยกบัญชีทดลองและบัญชีจริงออกจากกันเพื่อหลีกเลี่ยงข้อผิดพลาด

– อย่าพิมพ์ข้อมูลส่วนตัวหรือข้อมูลทางการเงินลงในแชต

– เปิดใช้งานการยืนยันตัวตนสองขั้นตอน (2FA) และเพิกถอนสิทธิ์การเข้าถึงที่ไม่ใช้งาน

นักวิเคราะห์ของ FBS ใช้แชตบอต AI อย่างไร?

นักวิเคราะห์ของ FBS ก็กำลังพัฒนาและปรับปรุงทักษะการเทรดและผลลัพธ์ของตนเองอย่างต่อเนื่องไม่ต่างกันกับลูกค้าของ FBS ต่อไปนี้คือข้อมูลเชิงลึกสามประการที่สามารถสร้างความแตกต่างได้อย่างแท้จริงในขณะที่คุณทำการซื้อขาย

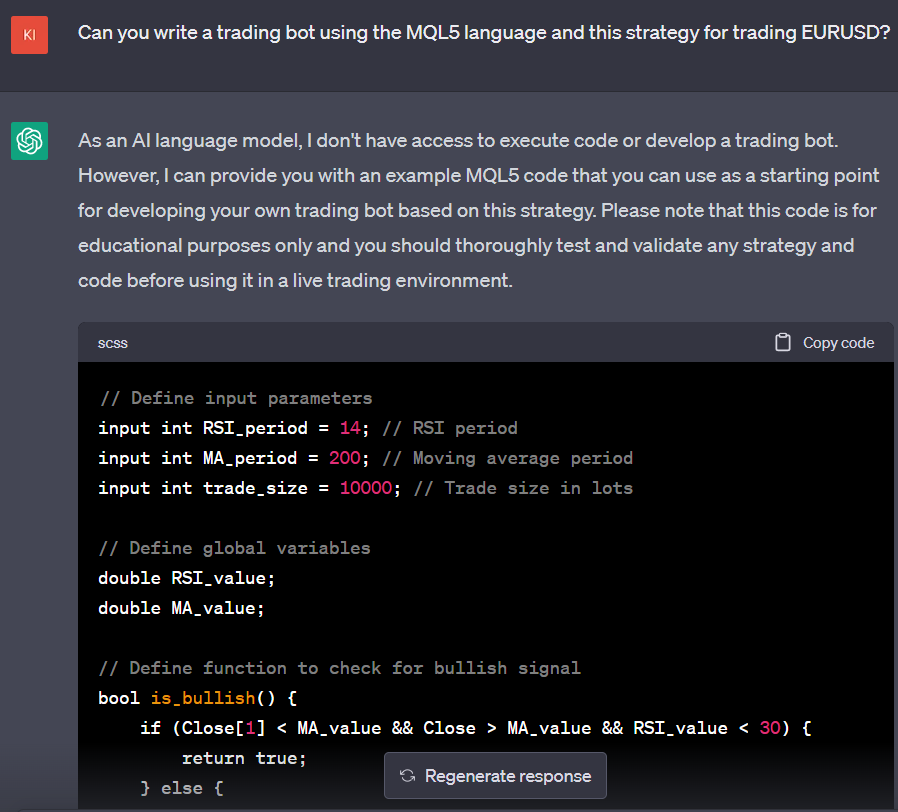

1. สร้างกลยุทธ์การเทรด

สมมติว่าคุณมีตัวชี้วัดสองตัวที่คุณชอบใช้ แต่คุณต้องการทราบวิธีการรวมตัวชี้วัดเหล่านี้เข้าไว้ในกลยุทธ์การเทรด ChatGPT สามารถแก้ปัญหานี้ได้

นี่คือบทสนทนา:

นักวิเคราะห์ FBS: สวัสดี แชต! ช่วยยกตัวอย่างกลยุทธ์การซื้อขายที่ใช้ 200-period MA ร่วมกับ RSI ให้หน่อย

ChatGPT: ได้เลย นี่คือตัวอย่างของกลยุทธ์การเทรดที่ผสมผสานระหว่าง 200-period moving average (MA) และ Relative Strength Index (RSI) เข้าด้วยกัน

ระบุแนวโน้มโดยใช้ 200-period MA หากราคาอยู่เหนือเส้น 200-period MA แนวโน้มเป็นขาขึ้น หากราคาอยู่ต่ำกว่าเส้น 200-period MA จะถือว่าแนวโน้มเป็นขาลง

ใช้ RSI เพื่อยืนยันสภาวะซื้อมากเกินไปหรือขายมากเกินไป ค่า RSI ที่อยู่สูงกว่า 70 บ่งชี้ถึงภาวะซื้อมากเกินไป ขณะที่ค่า RSI ที่อยู่ต่ำกว่า 30 บ่งชี้ถึงภาวะขายมากเกินไป

มองหาสัญญาณขาขึ้นเมื่อแนวโน้มเป็นขาขึ้น และค่า RSI อยู่ในภาวะขายมากเกินไป สัญญาณขาขึ้นจะเกิดขึ้นเมื่อราคาตัดขึ้นเหนือเส้น 200-period MA และค่า RSI อยู่ต่ำกว่า 30 ซึ่งบ่งชี้ถึงความเป็นไปได้ของการกลับตัวของแนวโน้ม

มองหาสัญญาณขาลงเมื่อแนวโน้มโดยรวมเป็นขาลง และค่า RSI อยู่ในภาวะซื้อมากเกินไป สัญญาณขาลงเกิดขึ้นเมื่อราคาตัดต่ำกว่าเส้น 200-period MA และค่า RSI อยู่เหนือระดับ 70 ซึ่งบ่งชี้ถึงความเป็นไปได้ในการกลับตัวของแนวโน้ม

ใช้คำสั่ง Stop Loss เพื่อจำกัดการขาดทุน หากการเทรดนั้นไม่ได้ขยับไปในทิศที่คุณต้องการ

ใช้คำสั่ง Take Profit เพื่อทำกำไรเมื่อการเทรดขยับไปในทิศที่คุณต้องการ

นักวิเคราะห์ FBS: ฉันควรวาง Stop Loss ไว้ที่จุดไหนเมื่อใช้กลยุทธ์นี้?

ChatGPT: การวางจุด Stop Loss ของคุณโดยใช้กลยุทธ์นี้จะขึ้นอยู่กับความเสี่ยงที่คุณยอมรับได้ ความผันผวนของตลาด และเป้าหมายการเทรดของคุณเอง โดยทั่วไปแล้ว จุด Stop Loss จะวางไว้ต่ำกว่าจุดต่ำสุดของการแกว่งตัวครั้งล่าสุดในการเทรดขาขึ้น และอยู่เหนือจุดสูงสุดของการแกว่งตัวครั้งล่าสุดในการเทรดขาลง สิ่งนี้จะช่วยจำกัดการขาดทุนได้หากตลาดเคลื่อนไหวสวนทางกับสถานะของคุณ

ในกรณีของกลยุทธ์นี้ หากคุณเปิด สถานะซื้อ (long) หลังจากที่เกิดสัญญาณขาขึ้น คุณสามารถตั้งค่า จุดตัดขาดทุน (Stop Loss) ไว้ต่ำกว่าจุดต่ำสุดของการแกว่งตัวล่าสุด หรือต่ำกว่าเส้น 200-period MA แล้วแต่จุดใดจะอยู่ต่ำกว่ากัน หากคุณเปิดสถานะขาย (short) หลังจากที่เกิดสัญญาณขาลง คุณสามารถตั้งค่า จุด Stop Loss ไว้ เหนือจุดสูงสุดของการแกว่งตัวล่าสุด หรือเหนือเส้น 200-period MA แล้วแต่จุดใดจะอยู่สูงกว่ากัน

น่าทึ่งมากเลยใช่ไหมล่ะ?