กลโกงฟอเร็กซ์ที่พบบ่อยที่สุด

ในโลกของฟอเร็กซ์ การตระหนักถึงแนวทางปฏิบัติในการเทรดที่ไม่เป็นธรรมนั้นเป็นเรื่องที่ต้องให้ความสำคัญ ไม่ว่าคุณจะเป็นเทรดเดอร์ที่มีประสบการณ์หรือมือใหม่ก็ตาม และในส่วนนี้จะเน้นถึงกลยุทธ์การโกงฟอเร็กซ์ที่พบบ่อยที่สุด เพื่อช่วยให้เทรดเดอร์สามารถระบุและป้องกันตนเองจากกิจกรรมที่ไม่ยุติธรรมในตลาดได้

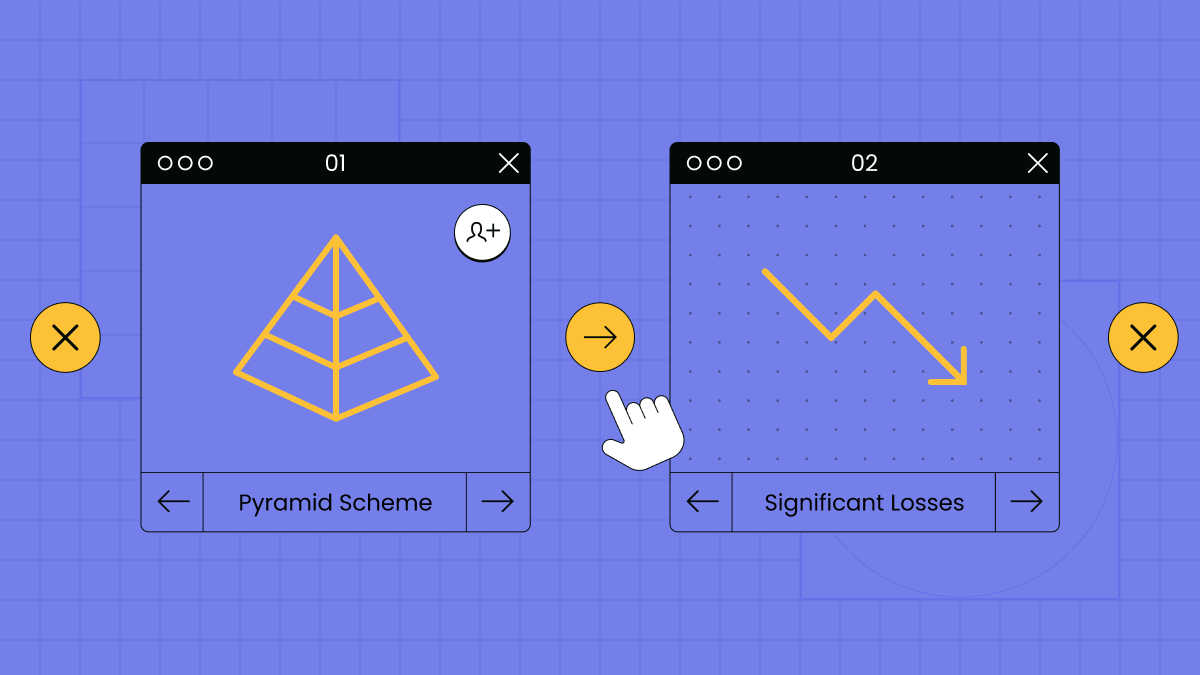

ธุรกิจแบบพีระมิดหรือแชร์ลูกโซ่

แชร์ลูกโซ่เป็นรูปแบบหนึ่งของการฉ้อโกงทางการเงินที่แทรกซึมอยู่ในอุตสาหกรรมฟอเร็กซ์ พวกเขาจะดักจับบุคคลด้วยคำสัญญาว่าจะได้กำไรมหาศาล แชร์ลูกโซ่จะซ่อนอยู่ภายใต้โอกาสในการลงทุนที่ถูกต้องตามกฎหมาย ผู้ก่อตั้งจะดำเนินการเป็นกองทุนที่รวบรวมเงินทุนเพื่อลงทุนในนามของลูกค้า กิจกรรมฉ้อโกงประเภทนี้มีพื้นฐานมาจากการสรรหาผู้เข้าร่วมใหม่ ๆ ที่ต้องทำการลงทุนเริ่มแรก โดยสัญญาว่าจะได้รับผลตอบแทนจำนวนมากผ่านการสรรหาผู้อื่นเข้าสู่โครงการหลอกลวงนี้ แชร์ลูกโซ่จะมุ่งเน้นไปที่สรรหาสมาชิกเพิ่ม ไม่ใช่การฝึกซื้อขาย ปิรามิดดังกล่าวจะเติบโตจนกระทั่งพังทลายลงอย่างกะทันหัน ทำให้เกิดความสูญเสียอย่างมากต่อนักลงทุนที่ถูกฉ้อโกง

สัญญาณอันตรายที่พบบ่อยสำหรับแชร์ลูกโซ่ในตลาดฟอเร็กซ์ ได้แก่:

- รับประกันผลตอบแทนจำนวนมาก

- ไม่มีกิจกรรมการเทรดจริง

- กดดันให้นำสมาชิกใหม่เข้ามาก่อนถึงจะได้เงิน

กลโกงบริการสัญญาณ

กลโกงบริการสัญญาณในตลาดฟอเร็กซ์เป็นรูปแบบที่แพร่หลายที่บุคคลหรือบริษัทจะรับประกันว่าพวกเขาจะส่งสัญญาณการซื้อขายที่เชื่อถือได้และแม่นยำให้แก่เทรดเดอร์โดยแลกกับค่าธรรมเนียม อย่างไรก็ตาม ผู้ให้บริการที่ฉ้อโกงเหล่านี้จะสร้างสัญญาณที่ส่งผลให้เกิดการสูญเสียอย่างมากแก่เหยื่อที่ไม่สงสัย

ในกลโกงบริการสัญญาณ ผู้กระทำผิดจะใช้ประโยชน์จากความปรารถนาของเทรดเดอร์ในการทำกำไรง่าย ๆ โดยอาศัยความเชี่ยวชาญของผู้อื่น พวกเขามักจะใช้กลยุทธ์ทางการตลาดที่น่าดึงดูด และสร้างการรับรู้ที่ผิดพลาดเกี่ยวกับความสำเร็จเพื่อหาคนมาสมัครสมาชิก เมื่อเทรดเดอร์ลงทะเบียนและชำระค่าธรรมเนียมการสมัครสมาชิก พวกเขาจะได้รับสัญญาณที่สร้างขึ้นแบบสุ่ม ๆ ที่ถูกออกแบบมาเพื่อชักจูงให้พวกเขาเข้าสู่การซื้อขายที่ขาดทุน

การกระทำทั่วไปที่เป็นสัญญาณของกลโกงสัญญาณฟอเร็กซ์:

- โน้มน้าวคุณว่าการเทรดฟอเร็กซ์เป็นเรื่องง่ายและคุณสามารถบรรลุความมั่งคั่งในชั่วข้ามคืนได้โดยไม่ต้องใช้ความพยายามหรือทักษะใด ๆ เลย

- กำหนดให้ต้องชำระเงินล่วงหน้าโดยไม่แสดงหลักฐานที่สามารถตรวจสอบได้เกี่ยวกับประสิทธิภาพของสัญญาณ

- มีส่วนร่วมในกลยุทธ์การตลาดเชิงรุก เช่น การโทรโดยไม่ได้นัดหมายหรืออีเมลขยะเพื่อกำหนดเป้าหมายเทรดเดอร์ที่ไม่มีประสบการณ์

- นำเสนอโบนัสเพื่อดึงดูดลูกค้าใหม่และขยายเครือข่าย

- ไม่สามารถให้การอัปเดตสัญญาณได้อย่างสม่ำเสมอ ส่งผลให้ข้อมูลมีความล่าช้าหรือล้าสมัย

ดังนั้น หากมีใครเสนอโอกาสให้คุณรวยอย่างรวดเร็ว พวกเขาก็มักจะรวยด้วยค่าใช้จ่ายของคุณ แต่คุณกลับไม่ได้อะไรเลย

กลโกงการจัดการบัญชีฟอเร็กซ์

กลโกงการจัดการบัญชีการซื้อขายในตลาดฟอเร็กซ์นั้นเกี่ยวข้องกับการเสนอบริการฉ้อโกงในการจัดการเงินทุนของเทรดเดอร์ในนามของพวกเขา โดยทั่วไปแล้ว นักต้มตุ๋นจะนำเสนอตัวเองว่าเป็นมืออาชีพและจะให้ข้อมูลเท็จเกี่ยวกับบันทึกการซื้อขายที่ประสบความสำเร็จ พวกเขาจะดึงดูดเทรดเดอร์โดยสัญญาว่าจะให้ผลตอบแทนสูงและมีความเสี่ยงน้อยที่สุด

ในการเข้าร่วมในโครงการ นักต้มตุ๋นจะขอให้เทรดเดอร์ฝากเงินจำนวนมากเข้าบัญชีจัดการ เพื่อชักชวนให้พวกเขาใช้สำหรับการเทรดฟอเร็กซ์ภายใต้ความเชี่ยวชาญของทีมของพวกเขา นักต้มตุ๋นจะสร้างภาพลวงตาของการซื้อขายที่กระตือรือร้นด้วยการให้รายงานและข้อความที่เป็นเท็จแก่เทรดเดอร์ แถมพวกเขายังอาจให้เทรดเดอร์เข้าถึงแพลตฟอร์มการซื้อขายออนไลน์ที่แสดงคำสั่งซื้อขายหลอก ๆ และผลกำไรที่สมมติขึ้นได้

นอกจากการลงทุนเริ่มแรกแล้ว นักต้มตุ๋นยังเก็บค่าธรรมเนียมการจัดการที่พวกเขาจะหักจากบัญชีของเทรดเดอร์เป็นประจำ ค่าธรรมเนียมเหล่านี้จะช่วยให้ผู้ให้บริการสร้างรูปลักษณ์ของกิจกรรมที่ชอบด้วยกฎหมายได้

เมื่อเวลาผ่านไป นักต้มตุ๋นมักจะเริ่มต้นการซื้อขายที่สูญเสียแบบติด ๆ กันหรือหยุดการซื้อขายไปโดยสิ้นเชิง สิ่งนี้ย่อมทำให้เหยื่อสูญเสียเป็นจำนวนมากอย่างหลีกเลี่ยงไม่ได้ เมื่อกลโกงล่มสลาย นักต้มตุ๋นก็จะหายตัวไป ตัดการสื่อสารทั้งหมด และทำให้ลูกค้าแทบไม่มีโอกาสได้รับเงินทุนคืนเลย

ไม่ว่าในกรณีใดก็ตาม คุณไม่ควรบอกรหัสผ่านของบัญชีฟอเร็กซ์ของคุณแก่ใครก็ตาม เพราะคุณจะสูญเสียการควบคุมเงินของคุณ และนักต้มตุ๋นมักจะหายตัวไปอย่างไร้ร่องรอย

สัญญาณอันตรายของกลโกงการจัดการบัญชี:

- เร่งให้คุณฝากเงินเข้าบัญชีซื้อขายฟอเร็กซ์ของคุณ

- ขาดความโปร่งใสในการตอบคำถามของเทรดเดอร์

- ขายบริการของตนแบบยัดเยียด

- การกล่าวอ้างที่ไม่สมจริงเกี่ยวกับผลการซื้อขาย

- อุปสรรคและความล่าช้าเมื่อเทรดเดอร์ต้องการถอนเงิน

โบรกเกอร์ฟอเร็กซ์ที่ไม่ได้รับการควบคุม

ในตลาดฟอเร็กซ์ โบรกเกอร์ที่ไม่ได้รับการควบคุมก่อให้เกิดความเสี่ยงที่สำคัญต่อเทรดเดอร์ โบรกเกอร์เหล่านี้จะดำเนินการโดยไม่ปฏิบัติตามกฎระเบียบ ส่งผลให้เทรดเดอร์เสี่ยงต่อการถูกฉ้อโกง โบรกเกอร์ที่ไม่ได้รับการควบคุมจะขาดใบอนุญาตที่จำเป็น การกำกับดูแลของผู้มีอำนาจ และความรับผิดชอบที่เกี่ยวข้อง ผู้เข้าร่วมตลาดเหล่านี้จะไม่สามารถรับประกันความเป็นธรรม การคุ้มครองลูกค้า และความโปร่งใสได้ นั่นเป็นเหตุผลว่าทำไมโบรกเกอร์ที่ฉ้อโกงจึงมักจะดำเนินการในเงามืด โดยซ่อนตำแหน่งที่แท้จริงของพวกเขาเอาไว้

การขาดการกำกับดูแลทำให้โบรกเกอร์ที่ฉ้อโกงสามารถมีส่วนร่วมในการปฏิบัติที่บิดเบือนได้ นักต้มตุ๋นอาจใช้เงินฝากของลูกค้าเพื่อค่าใช้จ่ายส่วนตัวหรือวัตถุประสงค์อื่นที่ไม่ได้รับอนุญาต โบรกเกอร์ที่ไม่ได้รับการควบคุมอาจจัดการข้อกำหนดมาร์จิ้นและเลเวอเรจที่เสนอให้กับเทรดเดอร์ ซึ่งทำให้เกิดความเสี่ยงมากเกินไปหรือเกิดการปิดสถานะของเทรดเดอร์โดยอัตโนมัติ โบรกเกอร์เหล่านี้อาจปั่นราคาหรือค่าสเปรดในแพลตฟอร์มการซื้อขาย ซึ่งนำไปสู่การดำเนินคำสั่งที่ไม่เอื้ออำนวย

โดยทั่วไปโบรกเกอร์ที่ไม่ได้รับการควบคุมจะไม่ให้ความคุ้มครองหรือค่าตอบแทนใด ๆ แก่เทรดเดอร์ที่เผชิญกับภาวะล้มละลายทางการเงินหรือการฉ้อโกง ซึ่งแตกต่างจากโบรกเกอร์ที่ได้รับการควบคุม

สัญญาณอันตรายที่ต้องระวัง:

- กลไกการแก้ไขปัญหาข้อร้องเรียนที่มีข้อจำกัดหรือไม่มีเลย

- ไม่มีเอกสารทางกฎหมายที่ชัดเจน

- คำเตือนและข้อเสนอแนะเชิงลบบนอินเทอร์เน็ต

- ขาดการคุ้มครองเทรดเดอร์

- ซ่อนตำแหน่งอยู่ของสำนักงานใหญ่ของโบรกเกอร์

FBS มีใบอนุญาตระดับโลกและเป็นโบรกเกอร์ที่เชื่อถือได้ บริษัทอยู่ในตลาดมาเป็นเวลา 14 ปีแล้ว ซึ่งช่วยลดความเสี่ยงของการโดนโกงได้

นักต้มตุ๋นฟอเร็กซ์บนสื่อสังคมออนไลน์

สื่อสังคมออนไลน์ได้กลายเป็นแพลตฟอร์มที่สมบูรณ์แบบสำหรับนักต้มตุ๋นฟอเร็กซ์ เครือข่ายสังคมออนไลน์ช่วยให้ผู้กระทำผิดสามารถเผยแพร่ข้อมูลและดึงดูดความสนใจของมวลชนได้อย่างง่ายดาย นักต้มตุ๋นเหล่านี้กลับใช้กลวิธีต่าง ๆ เพื่อหลอกลวงบุคคลและกระทำการฉ้อโกง

ตัวอย่างเช่น โดยการใช้สื่อสังคมออนไลน์ นักต้มตุ๋นสามารถสร้างโปรไฟล์ปลอมและปลอมตัวเป็นเทรดเดอร์ที่ประสบความสำเร็จหรือโบรกเกอร์ แล้ววางกับดักให้ผู้คนลงทุนในแผนการของพวกเขาหรือซื้อบริการปลอม ๆ ของพวกเขา นักต้มตุ๋นอาจโพสต์ข้อความเท็จและเรื่องราวของความสำเร็จที่ไม่สามารถบรรลุได้ แสดงให้เห็นถึงไลฟ์สไตล์ที่หรูหรา และสัญญาว่าจะให้ผลตอบแทนสูงแก่ผู้ติดตาม

นอกจากนี้ นักต้มตุ๋นดังกล่าวยังสามารถจัดการแข่งขันการซื้อขายแบบปลอม ๆ โดยสัญญาว่าผู้เข้าร่วมจะมีโอกาสได้รับเงินจำนวนมาก พวกเขาจะใช้กลยุทธ์เหล่านี้เพื่อรวบรวมข้อมูลส่วนบุคคลจากบุคคลที่ไม่สงสัยหรือโน้มน้าวให้พวกเขาฝากเงินเข้าบัญชีซื้อขายปลอม

อีกวิธีทั่วไปที่นักต้มตุ๋นฟอเร็กซ์ใช้บนสื่อสังคมออนไลน์คือการแพร่กระจายข้อมูลและการวิเคราะห์ตลาดที่เป็นเท็จ นักต้มตุ๋นเหล่านี้จะรับเงินจากเทรดเดอร์โดยสัญญาว่าจะให้การวิเคราะห์ที่ดี แต่กลับโพสต์กราฟและข่าวสารที่ทำให้เข้าใจผิดแทน

สัญญาณเตือนของกลโกงฟอเร็กซ์บนสื่อสังคมออนไลน์ ได้แก่:

- ข้อความและคำขอเป็นเพื่อนที่ไม่คาดคิด

- โปรไฟล์ปลอมพร้อมรูปภาพที่ขโมยมา

- กลยุทธ์การขายเชิงรุก

- ใช้ไวยากรณ์ไม่ถูกต้องและการสะกดคำที่ผิดพลาด

- การร้องขอข้อมูลส่วนบุคคลและการฝากเงินโดยตรง

- รับประกันผลกำไร

โรบอตซื้อขายปลอม

โรบอตซื้อขายหรือที่เรียกว่า Expert Advisors (EAs) เป็นโปรแกรมคอมพิวเตอร์เฉพาะที่ใช้อัลกอริธึมและกฎที่กำหนดไว้ล่วงหน้าเพื่อดำเนินการซื้อขายในตลาดการเงิน เช่น ตลากฟอเร็กซ์ โดยอัตโนมัติ กลไกเหล่านี้จะวิเคราะห์สภาวะตลาดและเปิดหรือปิดสถานะโดยไม่ต้องใช้ความพยายามด้วยตนเอง

แม้ว่าโรบอตซื้อขายที่ทำขึ้นมาอย่างถูกต้องจะมีประโยชน์ แต่ปัญหาของโปรแกรมฉ้อโกงกลับทวีความรุนแรงมากขึ้น โรบอตซื้อขายฟอเร็กซ์ปลอมเป็นโปรแกรมเชลล์ที่ไม่ได้ให้ประโยชน์จากการซื้อขายจริง เนื่องจากมันไม่ได้ใช้อัลกอริธึมหรือกลยุทธ์ที่มีประสิทธิภาพ เทรดเดอร์ที่ตกเป็นเหยื่อของกลโกงเหล่านี้ไม่เพียงแต่สูญเสียเงินที่พวกเขาใช้ในการซื้อโรบอต แต่ยังอาจประสบกับความสูญเสียจำนวนมากหากพวกเขาพึ่งพาสัญญาณการซื้อขายของโรบอต

สัญญาณเตือนของโรบอตซื้อขายฟอเร็กซ์ปลอม ได้แก่:

- โปรโมชันของโบรกเกอร์ปลอม

- แสดงให้เห็นว่าฟอเร็กซ์นั้นเป็นเรื่องง่าย และไม่จำเป็นต้องมีความรู้เฉพาะเจาะจงเพราะโปรแกรมสามารถทำงานในนามของคุณได้

- การรับประกันผลตอบแทนจำนวนมาก

- การขาดข้อมูลเกี่ยวกับการทำงานของโรบอต

- การออกแบบและการใช้ภาษาแย่ ๆ

วิธีที่ดีที่สุดในการหลีกเลี่ยงกลโกงนี้คือการใช้แหล่งข้อมูลที่เป็นทางการและเชื่อถือได้ เช่น ร้านค้าโรบอต MQL5 และอ่านบทวิจารณ์จากคนจริง ๆ บนเว็บไซต์ที่เชื่อถือได้

ขั้นตอนในการหลีกเลี่ยงกลโกงการเทรดฟอเร็กซ์

เพื่อลดความเสี่ยงในการตกหลุมพรางของนักต้มตุ๋นฟอเร็กซ์ และปกป้องเงินทุนของคุณ เทรดเดอร์ควรปฏิบัติตามกฎที่ผ่านการทดสอบมาแล้ว ซึ่งกฏที่ว่านั้น ได้แก่:

เลือกโบรกเกอร์ฟอเร็กซ์ที่ได้รับการควบคุมและเชื่อถือได้

เมื่อค้นหาโบรกเกอร์ฟอเร็กซ์ การเลือกโบรกเกอร์ที่ปฏิบัติตามกฎระเบียบที่กำหนดโดยหน่วยงานทางการเงินที่มีชื่อเสียงถือเป็นสิ่งสำคัญ ตัวอย่างเช่น FBS ที่เป็นโบรกเกอร์ที่ได้รับการควบคุมอย่างเต็มรูปแบบ เราให้ความสำคัญกับการปฏิบัติตามมาตรฐานที่เข้มงวดในด้านความโปร่งใสและความรับผิดชอบ การปฏิบัติตามข้อกำหนดทางกฎหมายและมาตรฐานอุตสาหกรรมทำให้แน่ใจได้ว่าเราได้ปฏิบัติตามหลักเกณฑ์เฉพาะเพื่อปกป้องผลประโยชน์ของเทรดเดอร์ของเรา

เพื่อประเมินความน่าไว้วางใจและความน่าเชื่อถือของเรา การตรวจสอบชื่อเสียงของโบรกเกอร์ที่มีศักยภาพของคุณภายในชุมชนการซื้อขายถือเป็นสิ่งสำคัญ ด้วยการที่ FBS มีลูกค้ามากกว่า 27 ล้านราย เราขอแนะนำให้คุณตรวจสอบบทวิจารณ์และคำติชมจากลูกค้าที่พึงพอใจของเรา

นอกจากนี้ การประเมินคุณภาพการสนับสนุนลูกค้าของโบรกเกอร์ที่คุณเลือกก็เป็นสิ่งสำคัญ ที่ FBS ทีมสนับสนุนลูกค้าของเราพร้อมให้บริการตลอด 24/7 ในหลายภาษา ไม่ว่าคุณจะมีคำถามหรือข้อกังวล เราพร้อมให้ความช่วยเหลือคุณอย่างทันท่วงทีและมีประสิทธิภาพ

หลีกเลี่ยงคำมั่นสัญญาว่าจะรับประกันผลกำไร

เทรดเดอร์ต้องคิดอย่างมีวิจารณญาณเมื่อเห็นว่ามีสัญญาว่าจะได้รับโชคลาภในการเทรดฟอเร็กซ์ มันสำคัญมากที่จะไม่เชื่อข้อความที่รับประกันผลตอบแทนที่ไม่ธรรมดาจากการลงทุน เทรดเดอร์ควรจำไว้ว่าการเทรดฟอเร็กซ์เป็นกระบวนการที่ท้าทายและมีความเสี่ยงโดยธรรมชาติ และไม่มีใครสามารถคาดการณ์การเคลื่อนไหวของตลาดได้อย่างแม่นยำ 100% การรักษามุมมองของความเป็นจริงและการทำความเข้าใจความเสี่ยงจะช่วยให้เทรดเดอร์ตัดสินใจได้อย่างรอบคอบและหลีกเลี่ยงที่จะตกเป็นเหยื่อของคำสัญญาที่ไม่มีมูลความจริง

ให้ความรู้แก่ตัวเอง

เช่นเดียวกับในด้านอื่น ๆ ความสำเร็จในการเทรดฟอเร็กซ์จำเป็นต้องมีความมุ่งมั่นอย่างต่อเนื่องในด้านการศึกษา ยิ่งคุณมีความรู้และความเข้าใจเกี่ยวกับการเปลี่ยนแปลงของตลาดมากเท่าไร คุณก็จะยิ่งมีความสามารถมากขึ้นในการระบุกิจกรรมที่ฉ้อโกงและตัดสินใจซื้อขายได้ดียิ่งขึ้น

โบรกเกอร์ที่มีชื่อเสียงหลายรายมอบสื่อการศึกษาคุณภาพสูงแก่ผู้ใช้ ซึ่งช่วยให้เทรดเดอร์ได้พัฒนาทักษะของพวกเขา ตัวอย่างเช่น โบรกเกอร์ FBS นำเสนอพื้นฐานทางวิชาการที่ครอบคลุมแก่ลูกค้าด้วยคู่มือฟอเร็กซ์ เคล็ดลับสำหรับเทรดเดอร์ สัมมนาออนไลน์ สัมมนา วิดีโอบทเรียน ฯลฯ ซึ่งทีมผู้เชี่ยวชาญและนักวิเคราะห์ตลาดที่เก่งที่สุดจะร่วมกันจัดทำและปรับปรุงทรัพยากรอันมีค่าเหล่านี้ทุกวัน

ใช้โอกาสทางการศึกษาเหล่านี้ให้เกิดประโยชน์สูงสุดเพื่อเพิ่มศักยภาพในการเทรดของคุณ และก้าวทันข่าวสารในตลาดฟอเร็กซ์ที่เปลี่ยนแปลงอยู่ตลอดเวลา

ค่อย ๆ เป็น ค่อย ๆ ไป

ให้ฝากเงินเพียงเล็กน้อยเมื่อเทรดกับโบรกเกอร์ฟอเร็กซ์เพื่อทดสอบความน่าเชื่อถือของพวกเขา สิ่งนี้จะทำให้คุณมีโอกาสประเมินประสิทธิภาพของโบรกเกอร์และใช้มาตรการป้องกันที่จำเป็นก่อนที่จะทำการลงทุนจำนวนมาก แนะนำให้ฝากเงินต่อหากคุณพอใจกับบริการของโบรกเกอร์เท่านั้น แนวทางนี้จะช่วยให้คุณลดความเสี่ยงให้เหลือน้อยที่สุดและทำการตัดสินใจได้อย่างรอบคอบเมื่อต้องเทรดกับโบรกเกอร์ฟอเร็กซ์ที่ถูกกฎหมาย

ปกป้องข้อมูลส่วนบุคคลและข้อมูลทางการเงิน

จำเป็นอย่างยิ่งที่ต้องใช้ความระมัดระวังและคิดให้รอบคอบก่อนที่จะแบ่งปันข้อมูลส่วนบุคคลใด ๆ เช่น รหัสผ่าน ข้อมูลบัตรเครดิต เอกสารทางการเงิน หรือรายละเอียดที่ละเอียดอ่อนอื่น ๆ กับแพลตฟอร์มหรือแหล่งที่มาที่ไม่ผ่านการตรวจสอบ

เชื่อใจตัวเอง

หากคุณรู้สึกว่าข้อเสนอนั้นดีเกินจริง ให้เชื่อสัญชาตญาณของคุณและลืมเกี่ยวกับการทำงานร่วมกับบุคคลหรือแพลตฟอร์มนั้นไปได้เลย การไว้วางใจความรู้สึกสัญชาตญาณของคุณสามารถเป็นเครื่องมือที่มีประสิทธิภาพในการปกป้องตัวเองจากการตกเป็นเหยื่อของกลโกงฟอเร็กซ์ จัดลำดับความสำคัญของการตัดสินของคุณเองและไว้วางใจตัวเองเสมอเมื่อต้องตัดสินใจในตลาดฟอเร็กซ์

การปฏิบัติตามกฎเหล่านี้จะช่วยป้องกันกลโกงที่อาจเกิดขึ้นและปกป้องความเป็นส่วนตัวและสุขภาพทางการเงินของคุณ

สรุป

ในฐานะตลาดการเงินที่ใหญ่ที่สุดและมีสภาพคล่องมากที่สุด ตลาดฟอเร็กซ์ไม่เพียงแต่ดึงดูดบุคคลที่แสวงหาความมั่งคั่งผ่านการซื้อขายสกุลเงินเท่านั้น แต่มันยังดึงดูดบุคคลที่ไม่ซื่อสัตย์ที่มุ่งแสวงหาผลประโยชน์จากผู้อื่นอีกด้วย เพื่อหลีกเลี่ยงการตกเป็นเหยื่อของกลโกงฟอเร็กซ์ เทรดเดอร์ควรมองหาโบรกเกอร์ที่ได้รับการควบคุมและมีชื่อเสียง และปฏิบัติตามกฎระเบียบที่กำหนดไว้

ลองพิจารณา FBS เป็นโบรกเกอร์ซื้อขายที่เชื่อถือได้และซื่อสัตย์ของคุณดูสิ แล้วคุณจะเห็นว่าการเทรดฟอเร็กซ์นั้นปลอดภัยมากเพียงใด

คำถามที่พบบ่อย (FAQ)

ฉันจะหลีกเลี่ยงกลโกงในการเทรดฟอเร็กซ์ได้อย่างไร?

เพื่อหลีกเลี่ยงกลโกงในการเทรดฟอเร็กซ์ ให้ปฏิบัติตามขั้นตอนเหล่านี้:

เลือกโบรกเกอร์ฟอเร็กซ์ที่ได้รับการควบคุม

ให้ความสำคัญกับคำกล่าวอ้างว่ารับประกันผลกำไร

หลีกเลี่ยงการให้ข้อมูลส่วนบุคคลกับแหล่งที่มาที่ไม่ได้รับการตรวจสอบ

ขยายขอบเขตการเทรดของคุณ

เชื่อมั่นในการตัดสินใจของคุณ

ใช้บัญชีทดลองเพื่อทดสอบแพลตฟอร์มการซื้อขาย

ฉันจะรู้ได้อย่างไรว่าโบรกเกอร์ฟอเร็กซ์ถูกกฎหมาย? เพื่อตรวจสอบว่าโบรกเกอร์ฟอเร็กซ์ที่เลือกนั้นถูกกฎหมายหรือไม่ เทรดเดอร์ควรทำการวิจัยอย่างละเอียด

ตรวจสอบว่าโบรกเกอร์รายนั้นปฏิบัติตามกฎระเบียบและมาตรฐานอุตสาหกรรมหรือไม่

เรียนรู้ว่าโบรกเกอร์รายนั้นมีความโปร่งใสเพียงใด โบรกเกอร์ที่ถูกกฎหมายมีความโปร่งใสเสมอเกี่ยวกับประวัติผลการดำเนินงาน เงื่อนไขการซื้อขาย และการให้บริการ

วิเคราะห์กลไกการปกป้องข้อมูลที่ละเอียดอ่อน

ตรวจสอบความน่าเชื่อถือและความเป็นมืออาชีพของฝ่ายสนับสนุนลูกค้า

ศึกษาชื่อเสียงของโบรกเกอร์ในชุมชนฟอเร็กซ์

ฉันควรทำอย่างไรหากฉันถูกหลอกในตลาดสกุลเงิน?

หากวันหนึ่งคุณตกเป็นเหยื่อของกลโกงในตลาดฟอเร็กซ์ การดำเนินการทันทีถือเป็นสิ่งสำคัญ นี่คือขั้นตอนต่าง ๆ ที่คุณต้องทำ:

รวบรวมหลักฐาน รวมถึงภาพหน้าจอ อีเมล และเอกสารที่เกี่ยวข้องทั้งหมด

หากการหลอกลวงเกิดขึ้นผ่านโบรกเกอร์ ให้ติดต่อพวกเขาทันทีและอธิบายสถานการณ์

ปรึกษาผู้เชี่ยวชาญด้านกฎหมายที่มีประสบการณ์ในกลโกงการเทรดฟอเร็กซ์

ติดต่อธนาคารหรือผู้ให้บริการชำระเงินของคุณเพื่อรายงานธุรกรรมหลอกลวง

แบ่งปันประสบการณ์ของคุณกับเทรดเดอร์รายอื่น ๆ ผ่านสื่อสังคมออนไลน์หรือแหล่งอื่น ๆ

กลยุทธ์ฟอเร็กซ์ใดที่ปลอดภัยที่สุด?

ไม่มีกลยุทธ์ใดเลยที่จะปกป้องเงินทุนทั้งหมดของคุณได้ เทรดเดอร์แต่ละคนมีสไตล์การซื้อขายและการยอมรับความเสี่ยงที่เป็นเอกลักษณ์ของตัวเอง ดังนั้นการพัฒนากลยุทธ์ที่สอดคล้องกับเป้าหมายและความชอบส่วนบุคคลของคุณจึงเป็นตัวเลือกที่ดีที่สุดในการเข้าถึงความสำเร็จในระยะยาว