ANZ lowered its variable home loan rates for new customers by 0.15 percentage points, cementing its lead as the big bank with the lowest rates. This move comes amidst growing competition among Australia’s major banks, with NAB recently cutting its rates by 0.40 points and CBA making reductions earlier in the year. While ANZ’s new rate of 6.09% attracts attention, existing customers must contact the bank to request the lower rate, as it won’t be applied automatically. Experts urge homeowners to take advantage of the competitive market by negotiating better deals before Christmas. NAB, meanwhile, predicts that the Reserve Bank of Australia may delay rate cuts until mid-2025, meaning homeowners waiting for RBA decisions could miss out on immediate savings.

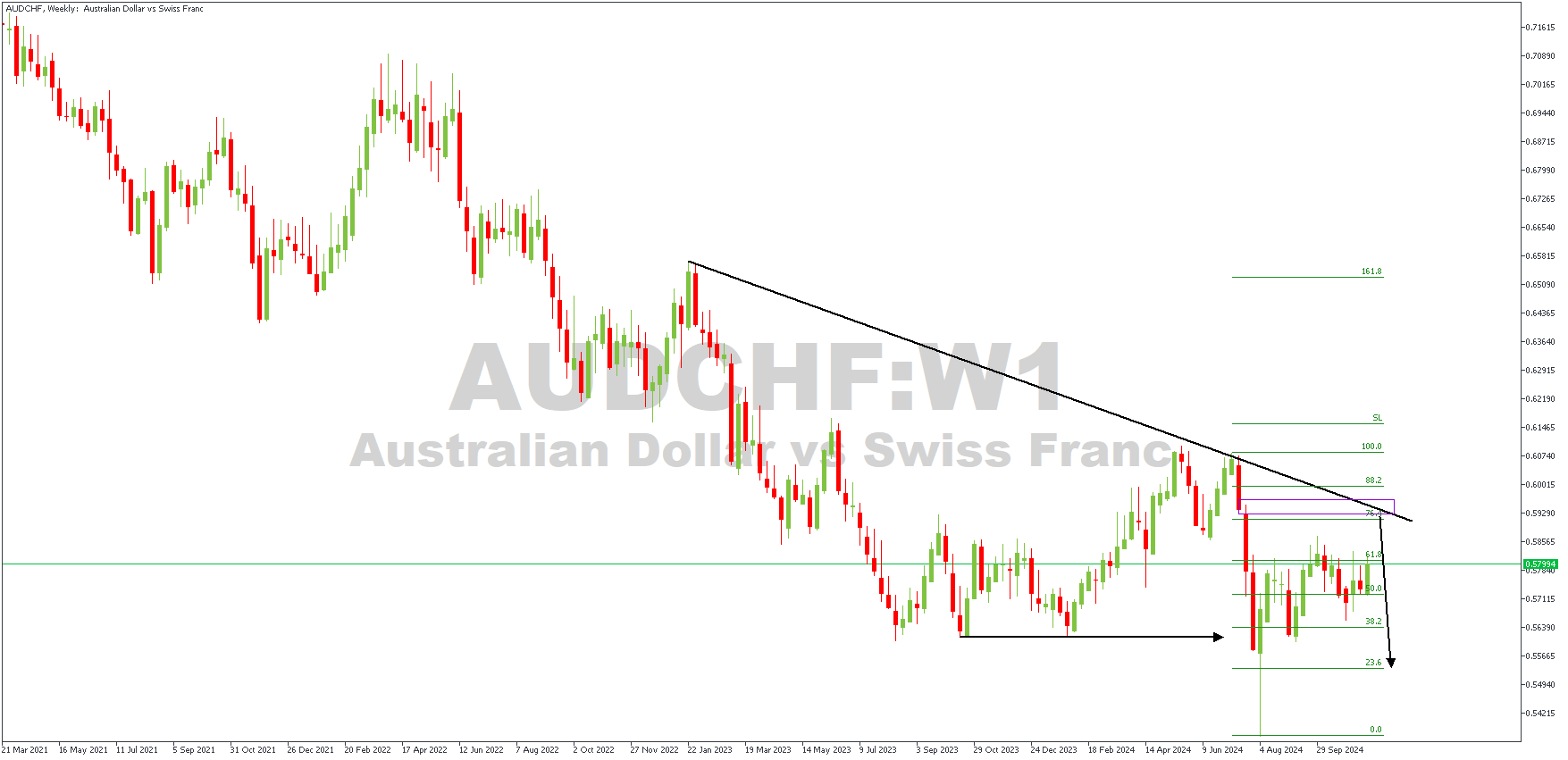

AUDCHF – W1 Timeframe

The price action on the AUDCHF weekly chart is approaching a resistance trendline, signaling continued bearish momentum as indicated by the downward arrow. A retracement to the 61.8% Fibonacci level, near 0.58050, was rejected, reinforcing the bearish bias. The next area of interest lies near the 76% Fibonacci level, around 0.59175, suggesting further downside potential. A stop-loss (SL) is recommended above the 88.2% Fibonacci level at 0.60050 to protect against invalidation of the bearish setup. Traders should wait for bearish confirmation on lower timeframes at the drop-base-drop supply zone for entry, targeting 0.55328 with a favorable risk-reward ratio.

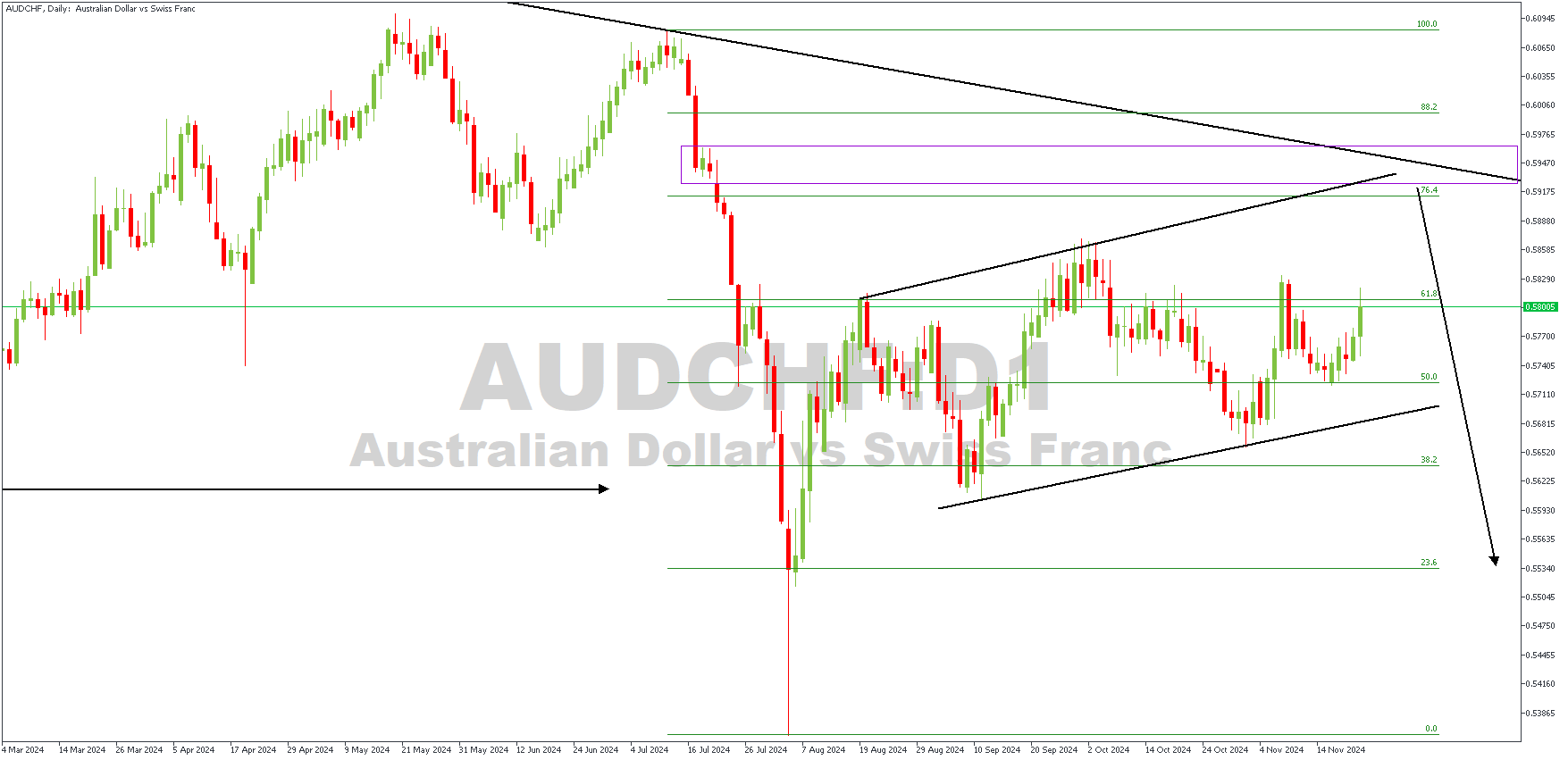

D1 Timeframe

The daily timeframe corresponds clearly with everything from the weekly timeframe chart described earlier. In this case, however, the price action provides additional details based on the consolidation channel currently being formed on the daily timeframe. Notably, the confluence of the resistance trendlines within the drop-base-drop supply zone and the 76% Fibonacci retracement level provide the necessary criteria for a bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target:0.55382

Invalidation: 0.60272

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.