สิ่งสำคัญของกลยุทธ์การซื้อขาย

ตอนนี้คุณรู้วิธีบริหารความเสี่ยงและคำนวณผลกำไรและขาดทุนของคุณแล้ว เดี๋ยวเรามาคุยเรื่องกลยุทธ์กัน เราจะอธิบายถึงกลยุทธ์ประเภทต่าง ๆ และเปิดคำสั่งซื้อขายโดยใช้ความรู้ทั้งหมดจากบทเรียนนี้

มาดูกลยุทธ์ยอดนิยมบางส่วนกัน:

การติดตามแนวโน้ม ดังคำกล่าวที่ว่า “แนวโน้มคือเพื่อนของคุณ” ในกลยุทธ์นี้ คุณจะระบุการเคลื่อนไหวขึ้นหรือลงที่รุนแรง และติดตามการเคลื่อนไหวนั้นโดยการเปิดคำสั่งซื้อขายในทิศทางเดียวกัน เมื่อเปิดคำสั่งซื้อขายแล้ว คุณสามารถเปิดเอาไว้ได้เป็นเวลานาน และหากแนวโน้มยังคงอยู่ กำไรของคุณก็จะเพิ่มขึ้นเรื่อย ๆ คำถามคือ ควรปิดคำสั่งซื้อขายตอนไหนดี ก่อนที่ราคาจะเริ่มตกลง

กลยุทธ์เบรกเอาต์ คุณรอให้ราคา "ทะลุแนวรับหรือแนวต้านสำคัญ" เมื่อสิ่งนั้นเกิดขึ้น คุณคาดว่าราคาจะเคลื่อนที่ต่ออย่างแข็งแกร่ง จากนั้นค่อยปิดคำสั่งซื้อขาย เราจะไม่พูดถึงเรื่องแนวรับและแนวต้านในหลักสูตรนี้ ดังนั้นโปรดดูโปรแกรมการสอนของเราสำหรับเรื่องนั้น

สมมติว่า EURUSD อยู่ในแนวโน้มขาขึ้นที่แข็งแกร่ง นั่นหมายความว่าราคากำลังปรับตัวสูงขึ้น โดยปกติแล้ว เทรดเดอร์จะรอให้ราคาปรับตัวลงเล็กน้อยก่อน แล้วจากนั้นค่อยเปิดสถานะซื้อ เทรดเดอต์จะรอให้ได้จุดเข้าที่ดีกว่าเพื่อเพิ่มโอกาสในการประสบความสำเร็จ

สิ่งที่คุณอาจทำได้ในฐานะเทรดเดอร์ มีดังต่อไปนี้:

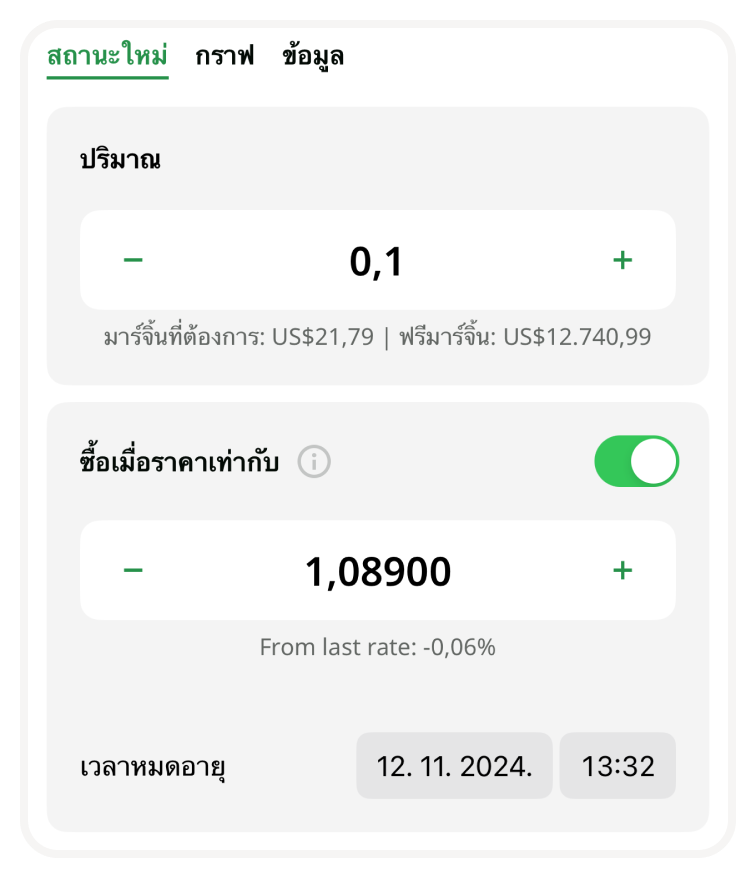

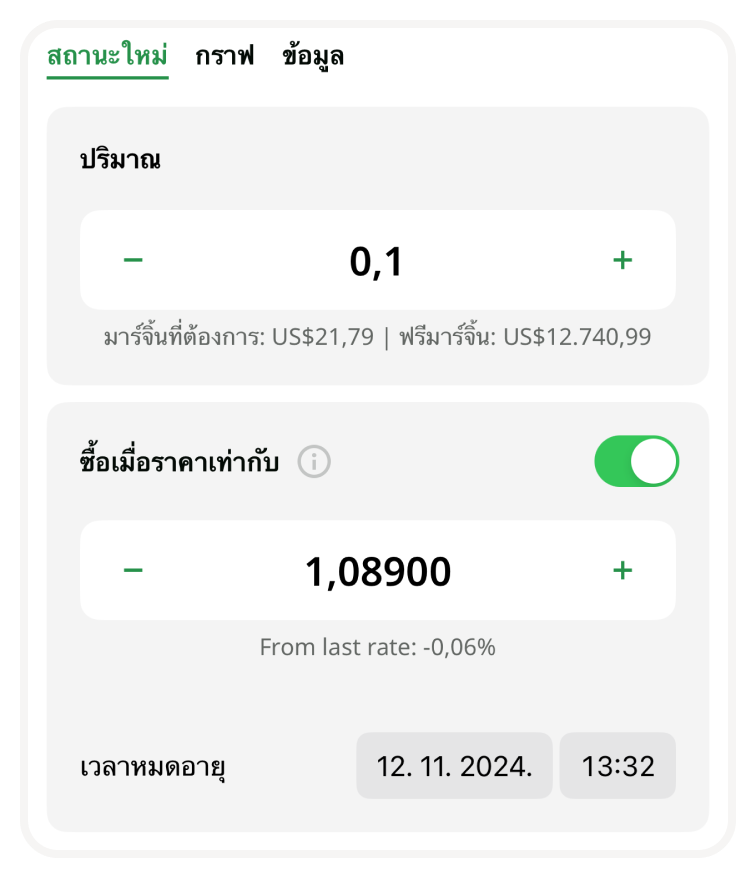

- เปิดกราฟ EURUSD และรอจุดเข้าที่ต้องการ มันอาจจะเป็นจุดใดก็ได้ ดังนั้นลองสมมติว่าคุณต้องการเข้าที่ราคา 1.08900

- คุณคลิกที่ ซื้อ และดูที่หน้า "สถานะใหม่" คุณสามารถเปลี่ยนขนาดคำสั่งซื้อขายของคุณได้ที่นี่ ลองเลือก 0.1 ล็อต เป็นตัวอย่าง แต่ละจุดที่นี่จะมีค่าเท่ากับ 0.1 ดอลลาร์ (ยังจำการคำนวณข้างต้นได้ไหมเอ่ย)

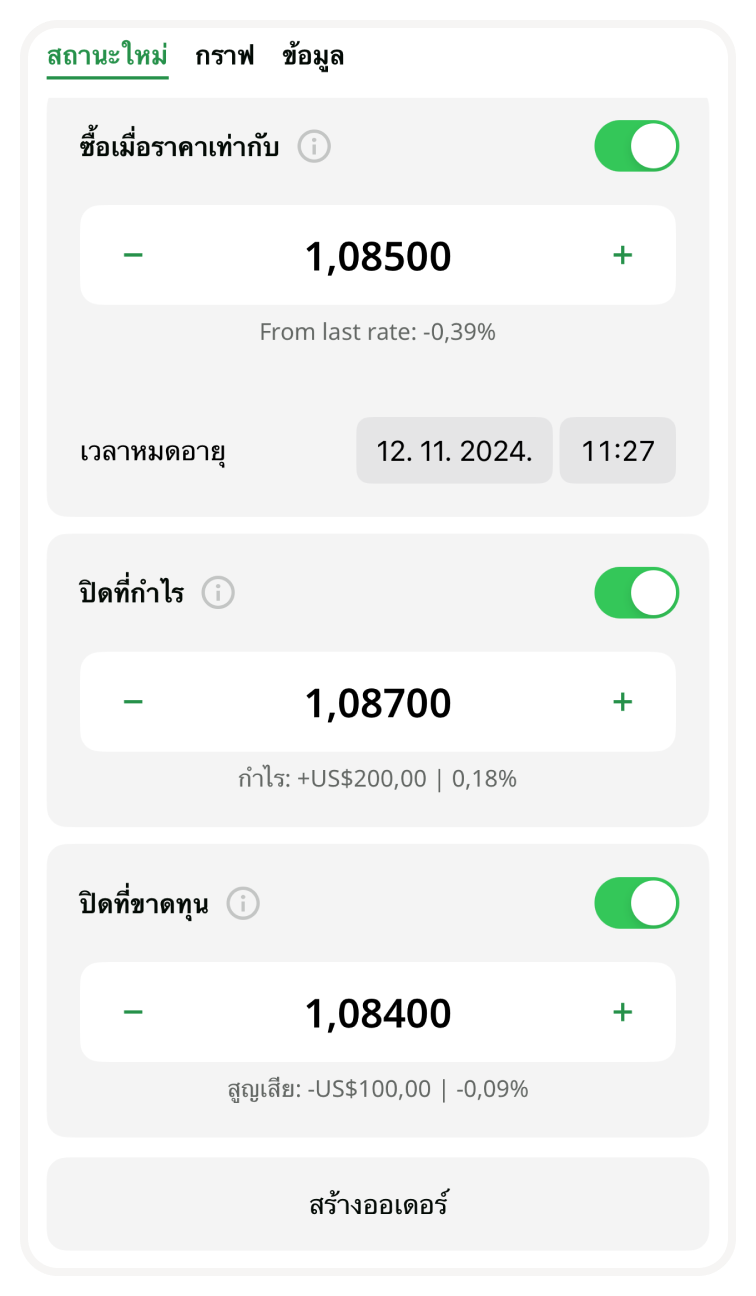

- เปิดสวิตช์ "ซื้อเมื่อราคาเท่ากับ" มันจะช่วยให้คุณสามารถเปิดคำสั่งซื้อขายในราคาที่คุณต้องการได้ แน่นอนว่าคุณต้องรอให้ราคามาถึงจุดนี้ สิ่งนี้มีประโยชน์อย่างยิ่งหากคุณต้องการคำนวณคำสั่งซื้อขายของคุณอย่างแม่นยำ

- ตั้งค่าเป็น 1.08900

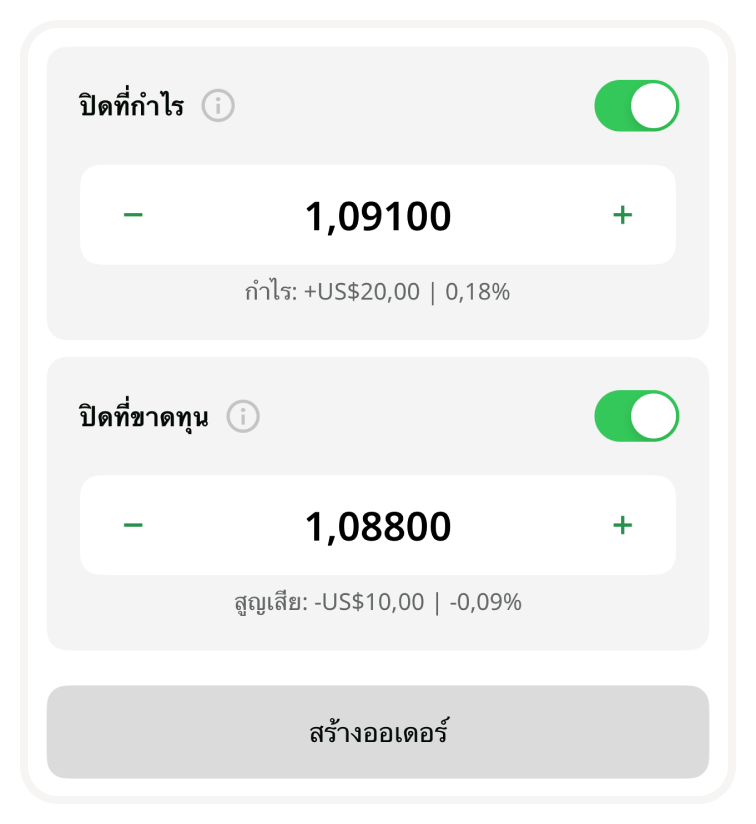

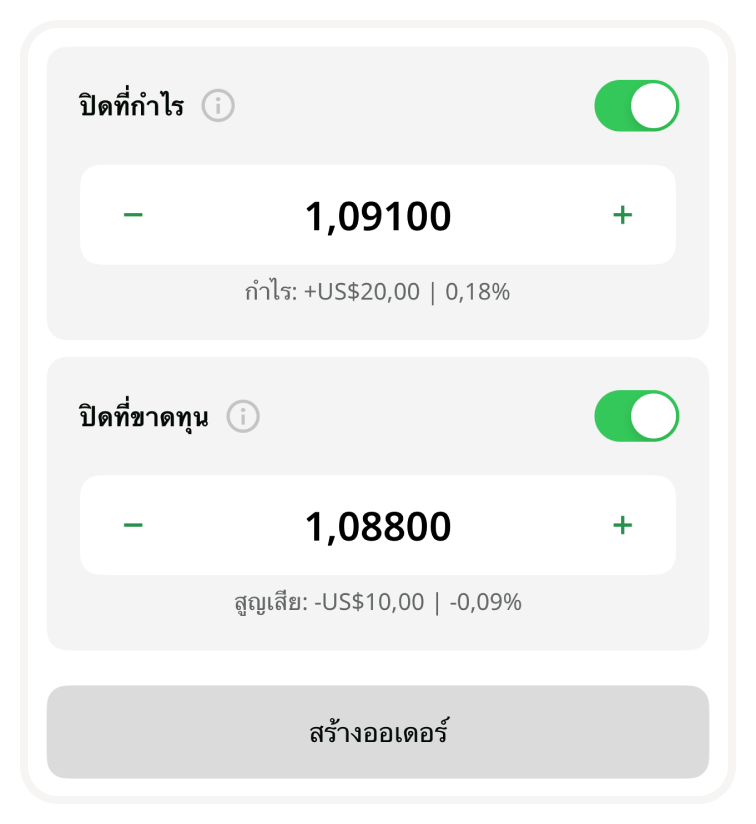

- เปิดสวิตช์ "ปิดที่กำไร" นั่นคือจุด take-profit ของคุณ เลือกค่าที่กำไรของคุณจะเท่ากับ 20 ดอลลาร์ ค่านี้อยู่ห่างจากราคาเข้าของคุณ 200 จุด จุด take-profit ของคุณจะเท่ากับ 1.08900 + 0.00200 = 1.09100 (จุดคือหลักสุดท้ายในราคา ดังนั้น 200 จุด จะเท่ากับ 0.00200)

- เปิดสวิตช์ "ปิดที่สูญเสีย" นั่นคือจุด stop-loss ของคุณ เลือกค่าที่การสูญเสียของคุณจะเท่ากับ 10 ดอลลาร์ ค่านี้จะอยู่ห่างจากราคาเข้าของคุณ 100 จุด จุด stop-loss ของคุณจะเท่ากับ 1.08900 – 0.00100 = 1.08800 (100 จุด จะเท่ากับ 0.00100)

แตะที่ปุ่ม วางคำสั่งซื้อขาย

ยินดีด้วยนะ! คุณเพิ่งเปิดคำสั่งซื้อขายตามที่ได้วางแผนมาแล้วเป็นอย่างดี!

การบ้าน

การบ้าน: เปิด แอป FBS แล้วส่งคำสั่งซื้อขายถัดไปของคุณอย่างมืออาชีพ โดยใช้ทุกสิ่งที่คุณได้เรียนรู้ไปแล้ว

ค้นหาคู่เงิน GBPUSD ในแอป

ค้นหาตำแหน่งที่คุณต้องการเปิดคำสั่งซื้อขาย

กำหนดปริมาณของคำสั่งซื้อขาย 0.1 ล็อต

กำหนดจุด Take Profit ของคุณห่างออกไป 200 จุด

กำหนดจุด Stop Loss ของคุณห่างออกไป 100 จุด

เปิดคำสั่งซื้อขาย

กลับไปที่คำสั่งซื้อขายของคุณในภายหลังเพื่อตรวจสอบ

โปรดจำไว้ว่า ให้เสี่ยงเฉพาะสิ่งที่คุณเต็มใจจะสูญเสีย แม้จะอยู่ในบัญชีทดลองก็ตาม นั่นคือวิธีคิดแบบเทรดเดอร์มืออาชีพ