Trade Idea for Gold (XAUUSD)

Usually, the Dollar and GOLD are negatively correlated. This means that the stronger the US-Dollar becomes, the lower Gold prices will be as many more investors will prefer liquid investments. Times of crisis and the need to safeguard funds are the major exceptions to this.

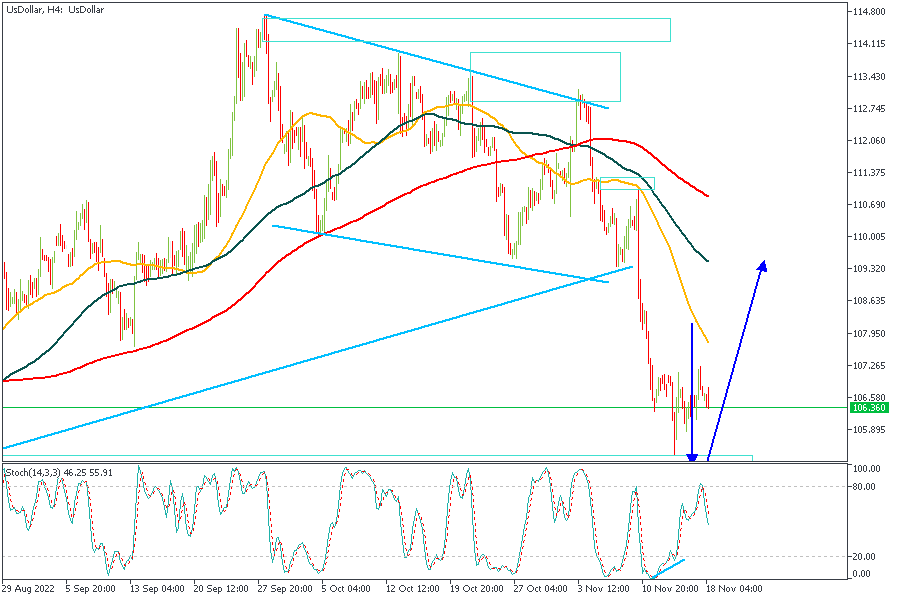

Judging from the background above, a bullish bias on the US Dollar could cause a bearish momentum on Gold. However, let's break down the bias a bit further.

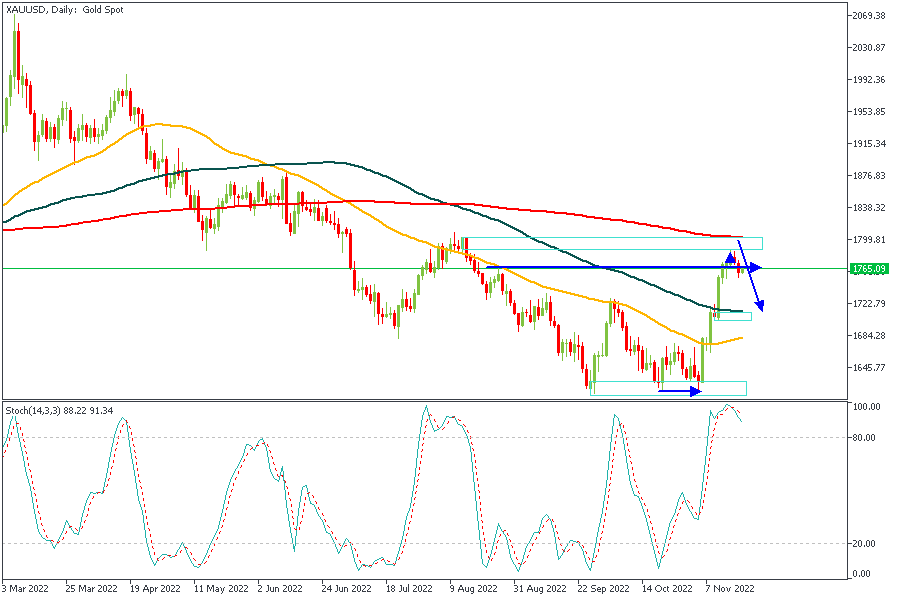

XAUUSD

Gold on the Daily timeframe is casually approaching the 200-Day Moving Average after absorbing liquidity from the 1765 price area whilst clearly overbought on the Stochastics Oscillator. It is also important to point out that the Supply zone I have marked out for a possible entry is within the range of 1788 and 1816 price points with initial targets at 1722, 1705, and 1680.

CONCLUSION

It is important to understand that the trading of CFDs comes at a risk; if not properly managed, you may lose all of your trading capital. To avoid costly mistakes while you look to trade these opportunities, be sure to do your own due diligence and manage your risk appropriately.

Log into your dashboard or create an account here to get started.